ISE08/15-16

| Subject: | financial affairs, renminbi internationalization, international financial centre |

- Offshore renminbi ("RMB") business has been growing by leaps and bounds in Hong Kong since 2009, boosted by a series of policy initiatives as well as product innovations from the private sector. As the range of RMB products is extended from personal to corporate and investment services, Hong Kong has sustained its top position amongst offshore RMB centres, taking up about 70% of the offshore RMB payment in the world.

- The remarkable growth of the offshore RMB business in Hong Kong contributes to RMB internationalization. In just around five years, RMB has ascended to the fifth largest currency in global payment in October 2015, taking up 1.9% of global payment, after the US Dollar (42.4%), Euro (29.9%), British Sterling (9.1%) and Japanese Yen (3.0%). Concurrently, RMB is the second largest currency in global trade finance, with a global share of 9.1%.

- On 30 November 2015, the International Monetary Fund ("IMF") decided to include RMB into the currency basket of Special Drawing Rights ("SDR"), with effect from 1 October 2016.1Legend symbol denoting SDR is an international reserve asset created by IMF to supplement its member countries' official reserves. SDR can be exchanged for freely usable currencies by eligible IMF member countries. Its value is based on a basket of key international currencies comprising the US dollar, Euro, Japanese Yen, British Sterling, and RMB (to be added with effect from 1 October 2016). The respective weights of the currencies in the basket beginning from that date will be 41.73%, 30.93%, 8.33%, 8.09% and 10.92%. With a weighting of 10.92%, RMB will overtake Japanese Yen and British Sterling to become the third largest currency in the basket, representing a milestone recognition of RMB as a global currency. It is widely believed that global demand for RMB-denominated assets will increase significantly further over time, creating abundant opportunities for offshore RMB products and services.

- The Panel on Financial Affairs regularly receives briefings by the Hong Kong Monetary Authority on the global, regional and local financial and economic conditions, including the development of the offshore RMB market in Hong Kong. This issue of Essentials highlights the key developments of the offshore RMB business in Hong Kong in recent years, followed by a discussion of the relative strengths of London and Singapore in the development of the offshore RMB business in the medium to longer term.

Salient developments of the offshore RMB business in Hong Kong

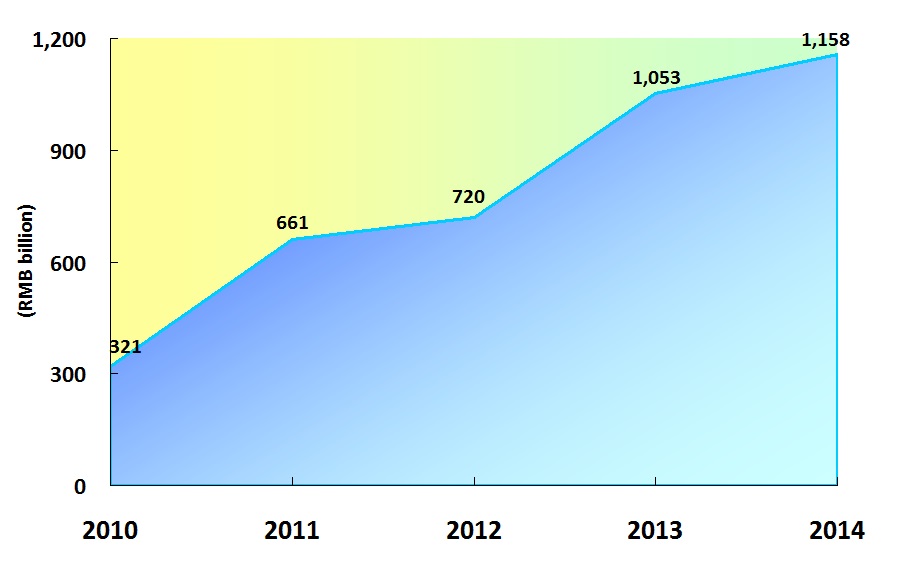

- Offshore RMB business in Hong Kong has experienced phenomenal growth in recent years, as manifested in the following key indicators. First and foremost, offshore RMB liquidity pool2Legend symbol denoting RMB liquidity is defined as the sum of customer deposits and outstanding certificates of deposit denominated in RMB. in Hong Kong is the largest in the world. During 2010-2014, the sum of RMB customer deposits and outstanding certificates of deposit surged by 2.6 times to reach RMB 1,160 billion (HK$1,500 billion) (Figure 1). According to an estimate of IMF, Hong Kong held under half of the offshore RMB deposits in the world in 2014. This liquidity pool nevertheless underwent some downward pressure during 2015, despite the removal of the daily conversion ceiling of RMB 20,000 (HK$25,300) in November 2014 and upon the devaluation of RMB more recently. At the end of October 2015, customer deposits eased back to RMB 854 billion (HK$1,041 billion).

Figure 1 - Liquidity pool of RMB in Hong Kong

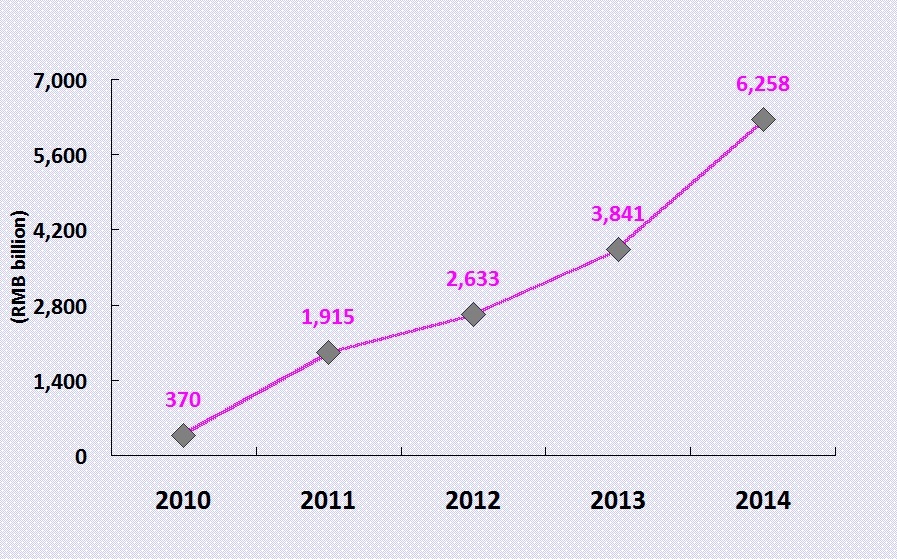

Data source : Hong Kong Monetary Authority. - Secondly, Hong Kong is the largest offshore hub in RMB trade settlement, taking up more than 90% of the global total. During 2010-2014, the amount of RMB trade settlement in Hong Kong has surged almost 16 times to reach RMB 6,300 billion (HK$7,900 billion) in 2014, upon increasing acceptance of RMB in global trade invoicing and payment (Figure 2).

Figure 2 - RMB trade settlement in Hong Kong

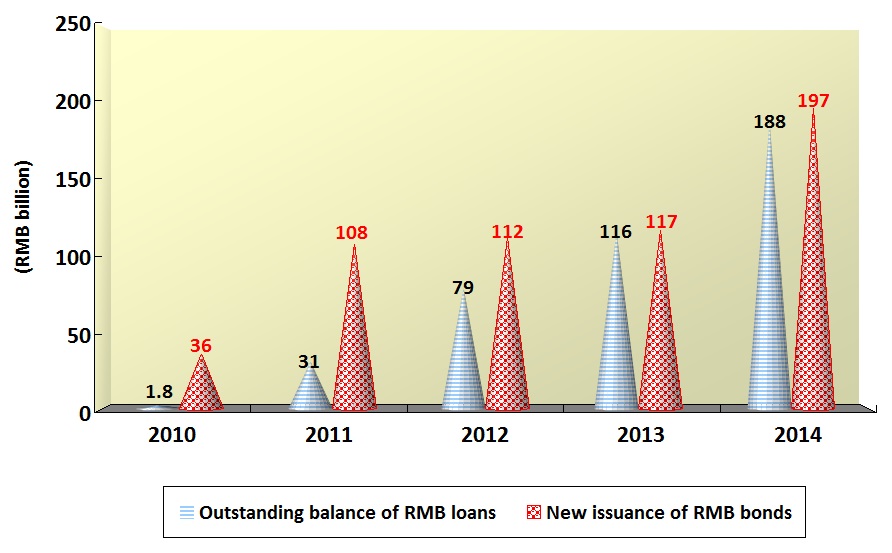

Data source : Hong Kong Monetary Authority. - Thirdly, Hong Kong is the largest offshore financial centre in making bank loans and issuing bonds denominated in RMB. By end-2014, the outstanding balance of RMB loans extended by local banks leapt by 103 times in four years to hit RMB 188 billion (HK$235 billion), while new issuance of RMB-denominated bonds surged by 4.5 times over the same period (Figure 3). However, demand for offshore RMB financing has weakened somewhat in 2015 with only RMB 51 billion (HK$62 billion) new issuance of RMB bonds in the first eight months, due probably to the series of interest rate cuts in the Mainland.3Legend symbol denoting Over the course of 2015, the one-year RMB benchmark loan interest rate in the Mainland has been cut by five times, with a total of 1.25 percentage points. Lower interest cost in the Mainland has diverted some of financing demand from offshore to onshore.

Figure 3 - Outstanding RMB loans and new issuance of RMB bonds

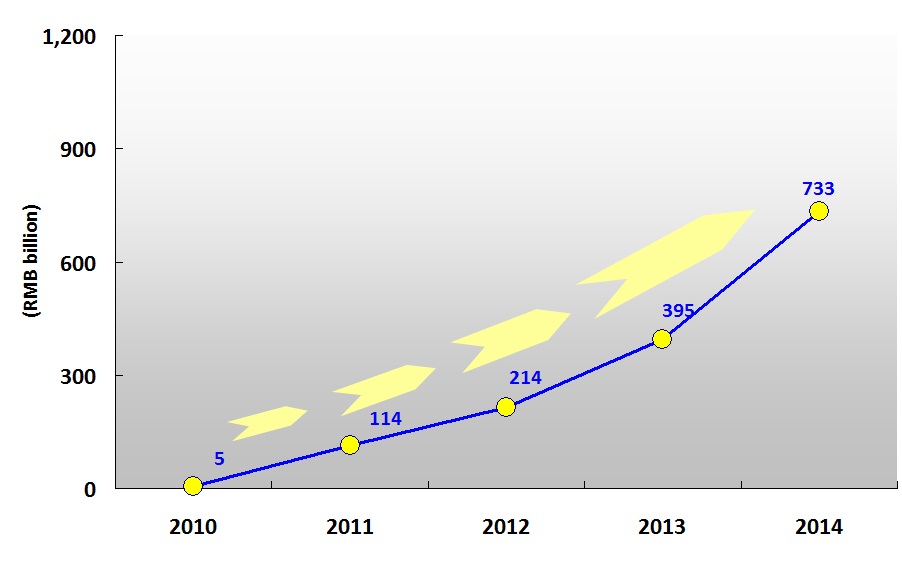

Data source : Hong Kong Monetary Authority. - Fourthly, the RMB clearing system in Hong Kong is most widely used by global financial institutions, capturing a global share of 70%. Leveraging on its first-mover advantage and its strong linkage to over 200 local and overseas participating banks, the Real Time Gross Settlement ("RTGS") System in Hong Kong has out-performed the other offshore RMB clearing systems by a wide margin. In 2014, the average daily turnover of RMB settlement in Hong Kong has surged by 146 times over four years to hit RMB 733 billion (HK$923 billion), with a global share of around 70% (Figure 4).4Legend symbol denoting According to the Hong Kong Monetary Authority, offshore transactions accounted for about 90% of the volume of RMB settlement in Hong Kong, while the remaining 10% was related to cross-border transactions between Hong Kong and the Mainland. That said, RTGS is facing a challenge upon establishment of a new global RMB settlement platform, namely Cross-border Inter-bank Payment System ("CIPS") in Shanghai in October 2015.5Legend symbol denoting CIPS is designed to provide clearing and payment services for financial institutions in the cross-border RMB and offshore RMB businesses. The first phase, kicked off in October 2015, supports the settlement of cross-border trade, cross-border direct investment, cross-border financing and fund transfer for individual customers, etc. It serves as a new alternative for financial institutions to execute RMB settlement, apart from routing it through the designated offshore RMB clearing banks or RMB agent banks. It merits close monitoring whether it will have a bearing on RTGS over time.

Figure 4 - Average daily turnover of the Real Time Gross Settlement System from 2010 to 2014

Data source : Hong Kong Monetary Authority. - Fifthly, the offshore RMB business in Hong Kong has spearheaded into the capital market upon the launch of Shanghai-Hong Kong Stock Connect in November 2014. While this initiative links up the stock markets of the two places together for the first time, it takes time for investors in the Mainland and Hong Kong to get familiar with the stock markets across the border. As such, over the past year since its launch, only 40% of the aggregate quota was used up in northbound trading and 37% in southbound trading. As a first step to open up the capital markets in the Mainland to the rest of the world, the market expects that this initiative will be followed by the launch of the Shenzhen-Hong Kong Stock Connect before long.

- Sixthly, the local offshore RMB business has spread to asset management upon the launch of the Mainland-Hong Kong Mutual Recognition of Funds ("MRF") in July 2015. This new initiative allows asset management companies in Hong Kong and the Mainland to market their investment fund products across the border. This pioneering move is expected to expedite investment flows across the capital markets in these two places over time.

Emerging strengths of London and Singapore in the offshore RMB business

- Notwithstanding the above achievements, Hong Kong is facing increasing competition from other offshore financial centres, as RMB continues its internationalization path. As the number of offshore RMB centres with clearing banks has already risen to 20 across the globe6Legend symbol denoting See新華社中國金融資訊網(2015)., these places will generate local demand for RMB-denominated assets and products. It is deemed more difficult for Hong Kong or other offshore hubs to compete for additional RMB business generated from these newly-grown markets, as the local financial institutions there tend to have a stronger business relationship with the local companies.

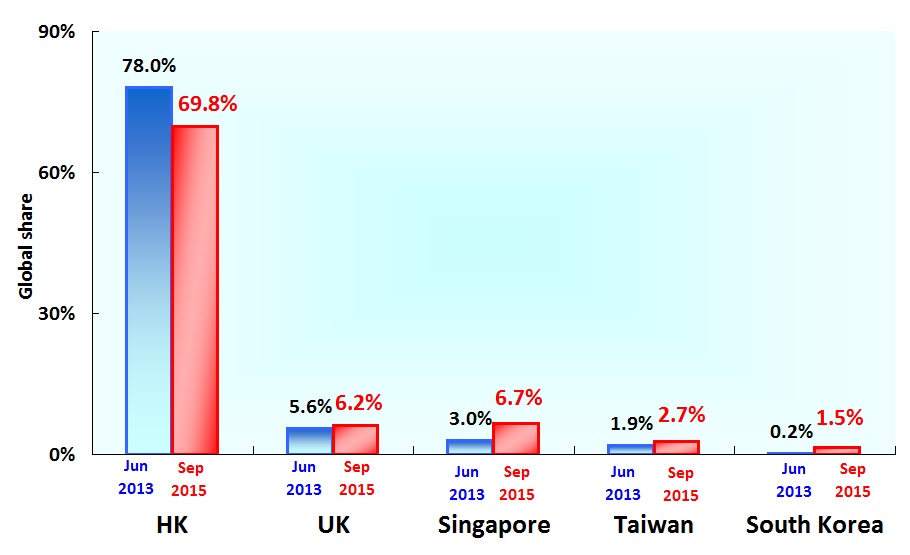

- The emerging strengths of other offshore RMB centres are reflected in the statistics on global RMB payment compiled by the Society for Worldwide Interbank Financial Telecommunication ("SWIFT"). Between June 2013 and September 2015, the global share of Hong Kong in RMB payment has declined visibly, from 78.0% to 69.8%. On the other hand, the global share of Singapore in RMB settlement has doubled from 3.0% to 6.7%, while the United Kingdom ("UK"), South Korea and Taiwan all registered gains in global share by various magnitudes (Figure 5).

Figure 5 - Global share of selected offshore renminbi centres in terms of RMB payment

Data source : Monthly RMB Tracker, SWIFT. - However, it is cautioned that as Hong Kong has embarked on the offshore RMB business much earlier than other places, its growth rate is bound to be slower than other emerging offshore centres, against a much higher base of comparison. Apart from RMB payment, the above trend is also reflected in other indicators such as offshore RMB deposits, outstanding balance of bonds and daily foreign exchange turnover of offshore RMB.7Legend symbol denoting For example, Singapore and Taiwan held RMB deposits of just RMB 225 billion (HK$272 billion) and RMB 322 billion (HK$389 billion) respectively as at September 2015. The outstanding balance of RMB bonds amounted to just around RMB 50 billion (HK$62 billion) in Singapore as at June 2015 and RMB 60 billion (HK$72.5 billion) in Taiwan as at September 2015. For London, its average daily turnover of RMB foreign exchange was about half of that in Hong Kong in 2013. See Bank of International Settlements (2013), Central Bank of Taiwan (2015), and Monetary Authority of Singapore (2015).

- That said, some offshore RMB centres do have unique strengths in certain kinds of RMB business. Taking London as an illustration, its main competitive strengths in the offshore RMB business are outlined as follows:

(a) London is the largest foreign exchange centre in the world, taking up as much as 40% of foreign exchange transactions; (b) London has a strong cluster of global financial institutions and a light touch regulatory regime in the offshore financial business8Legend symbol denoting Bank of England traditionally allowed relatively free foreign currency transactions, leading to financial innovation particularly in the Eurodollar market., favouring product innovation; and (c) London falls into a time zone eight hours behind Asia, making it an ideal hub to offer offshore RMB services in the Western hemisphere, and by extension an indispensable link in providing round-the-clock RMB services across the globe. - In September 2015, London was the third largest offshore RMB centre in terms of offshore RMB settlement. Leveraging on its strengths in foreign exchange transactions and global payments, London is expected to have good potential to roll out more competitive and innovative offshore RMB products in due course.

- As to Singapore, its competitive strengths in the offshore RMB business are outlined as follows:

(a) Singapore is already the third largest foreign exchange centre in the world, with a global share of 6%, generating a strong synergy effect on the offshore RMB business; (b) Singapore is the largest hub for commodity trading in Asia. It is home to over 80% of top oil and gas companies and 70% of top metals and mining companies. Being a trading centre in a host of commodities (e.g. natural rubber, palm oil, soya bean and cotton), Singapore has strong competitiveness in RMB-denominated commodity trading; (c) Singapore is a key hub for the 10 member states in the Association of Southeast Asian Nations ("ASEAN"), with a total population size of 620 million and strong development potential in this economic hinterland in the longer term; and (d) Singapore is strategically located on the "21st Century Maritime Silk Road", a vision advocated by President Xi Jinping for the promotion of trade links, capital flows, infrastructural investment and policy coordination among different places. - Buoyed by the above financial business and strategic advantages, Singapore has already overtaken London to become the second largest offshore RMB centre in the world. Moreover, Singapore is renowned for its value-added corporate solutions (e.g. hedging, treasury operation and wealth management), which can be attractions for its offshore RMB business, especially in commodity trading and foreign currency trading.

Implications for Hong Kong

- Hong Kong has out-performed other financial centres in the offshore RMB business, partly due to (a) its intimate economic relationship with the Mainland; (b) first-mover advantage in the offshore RMB business; and (c) sound financial infrastructure and synergy effect arising from its position as the third largest financial centre in the world. While Hong Kong can expect more business opportunities amidst further RMB internationalization, there is a view that it should not underestimate the challenges posed by the other offshore RMB centres such as Singapore and London. There may be a need for Hong Kong to continue to expand its role as the premier offshore RMB centre and key asset management centre in order to maintain its leadership position in the future.

Prepared by Tiffany NG

Research Office

Information Services Division

Legislative Council Secretariat

30 December 2015

Endnotes:

References:

| 1. | Australian National University. (2015) Renminbi International and the Evolution of Offshore RMB Centres: opportunities for Sydney, November 2015.

|

| 2. | Bank of China (Hong Kong). (2014) An analysis of the latest developments and comparative advantages of offshore RMB centers.

|

| 3. | Bank of International Settlements. (2013) BIS Triennial Survey 2013.

|

| 4. | Central Bank of Taiwan. (2015) Official website.

|

| 5. | Hong Kong Exchanges and Clearing Limited. (2015) Official website.

|

| 6. | Hong Kong Monetary Authority. (2015) Official website.

|

| 7. | Hong Kong Monetary Authority. (2015a) Briefing to the Legislative Council Panel on Financial Affairs on 2 November 2015. LC Paper No. CB(1)57/15-16(02).

|

| 8. | Hong Kong Monetary Authority. (2015b) Hong Kong - The Premier Offshore Renminbi Business Centre, April 2015.

|

| 9. | International Monetary Fund. (2015a) Review of the method of the Valuation of the SDR - IMF Policy Paper.

|

| 10. | International Monetary Fund. (2015b) Review of the method of the Valuation of the SDR - Initial consideration.

|

| 11. | London Stock Exchange. (2015) Official website.

|

| 12. | Monetary Authority of Singapore. (2015) Official website.

|

| 13. | SWIFT. (2015) Official website.

|

| 14. | SWIFT. (various years) RMB Tracker.

|

| 15. | The People's Bank of China. (2015) Official website.

|

| 16. | 《人民幣國際化報告》,中國人民銀行,2015年6月。

|

| 17. | 《人民幣國際化月報》,新華社中國金融資訊網,2015年11月。 |