ISE15/15-16

| Subject: | financial affairs, financial technologies, Fintech, distributed ledger, shared ledger |

- In his latest 2016-2017 Budget Speech, the Financial Secretary announced that the Government would encourage the industry and relevant organizations to explore the application of the blockchain technology in financial services, with a view to developing its potential to reduce suspicious transactions and bring down transaction costs.

- Blockchain is a new technology to create a digital ledger of transactions maintained by a network of computers, obviating the need for the type of middlemen or centralized authorities that traditionally conduct, authorize or verify the transactions.1Legend symbol denoting See PricewaterhouseCoopers (2016). Its applications can go beyond mitigating fraud or lowering the cost of doing business. For example, blockchain is currently the technology behind the transactions of virtual currencies, most notably Bitcoin.2Legend symbol denoting Bitcoin, being the first virtual currency, was launched in 2009. It is an internet-based currency and its payment system requires no intermediaries for reconciliation and clearance. Other virtual currencies in existence include Litecoin and Peercoin. They are commonly referred to as "cryptocurrencies". See Bank of England (2014). In trade finance, blockchain helps prevent duplicate financing of the same invoice by different banks.

- According to the Report of the Steering Group on Financial Technologies3Legend symbol denoting The Government established the Steering Group on Financial Technologies in April 2015 to advise on how to develop Hong Kong into and promote Hong Kong as a Fintech hub. The Steering Group released its report in February 2016 setting out its analysis and recommendations. released in February 2016, blockchain may become an underlying technology for a low-cost and transparent transaction infrastructure. Hong Kong has the potential to become a key blockchain technology hub through leveraging on its expertise in finance, logistics and other professional services. This issue of Essentials aims to (a) describe the blockchain technology and its key features, (b) discuss its potential applications and initiatives being undertaken in the overseas financial markets, and (c) highlight the challenges of adopting the technology.

What is "blockchain"

- Blockchain is generally referred to as a database or digital ledger on which transactions are recorded. The term blockchain is derived from the two words "block" and "chain". An individual "block" refers to all of the transactions which have taken place within a fixed period of time.4Legend symbol denoting The important parts of a block are: (a) its header, which includes information such as a unique block reference number, the time the block was created and a link to the previous block; and (b) its content, which is usually a validated list of digital assets and instruction statements, such as transactions made, their amounts and addresses of the parties to those transactions. See Deloitte (2016). Each block is "chained" to the next block mathematically and sequentially to form a blockchain. Given the latest block, it is possible to access previous blocks linked together in the chain. A blockchain database, thus, retains the complete history of all assets and instructions executed since the very first one - making its data verifiable and independently auditable. This in turn allows blockchain to be used as a ledger which can be shared and corroborated by anyone with the appropriate permissions.

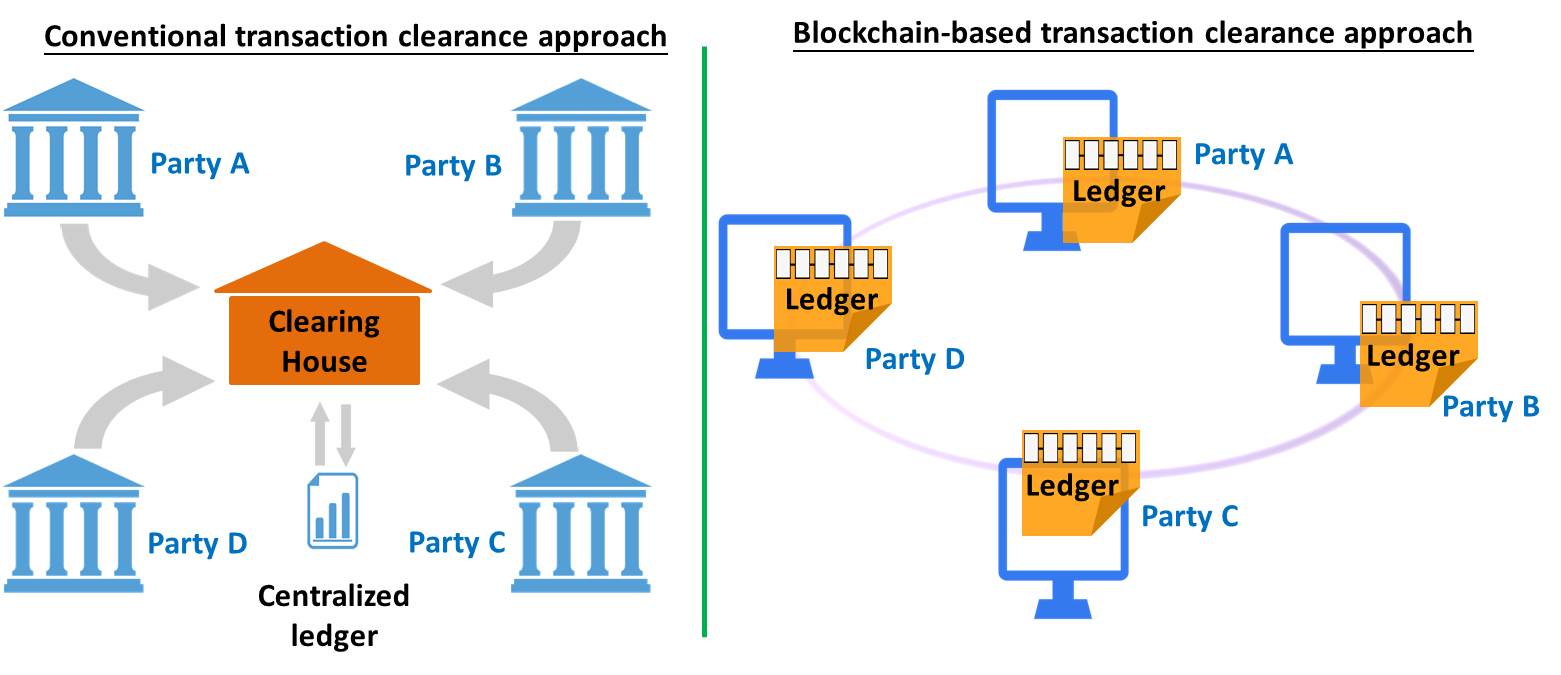

- As mentioned above, one of the key attributes of the blockchain technology is that it can eliminate the need for a central intermediary to verify and clear transactions. The difference between the conventional approach and blockchain-based approach to transaction clearance is illustrated in Figure 1 below. In a blockchain network, each computer maintains an identical copy of the blockchain, which is updated automatically every time a new transaction takes place. Computers verify each transaction with sophisticated algorithms to confirm the transfer of value and other information and create a historical ledger of all valid activities. The network computers that are processing the transactions are often spread across places and not owned or controlled by any single entity. Since a blockchain is distributed in the network instead of being stored on a central server, it is sometimes referred to as a distributed ledger.

Figure 1 - Two different approaches to transaction clearance

Sources: Oliver Wyman (2015) and IBM Corporation (2016). - In practice, a blockchain-based system can be in public or private setting. A public blockchain is open to everyone who can read or contribute data to the ledger, similar to that applied in virtual currency transactions. A private blockchain is a network where the participants are known a priori and have permission to update the ledger. Participants may come from the same organization or from different organizations within an industry sector where the relationships between them are governed by informal agreements, formal contracts or confidentiality arrangement.5Legend symbol denoting See Deloitte (2016).

- To recapitulate the above, a blockchain-based system possesses the following key features:6Legend symbol denoting See, for example, Oliver Wyman (2015), Deloitte (2016), and DTCC (2016).

(a) it is able to constantly validate the transactions based on the mathematical rules without requiring a third-party intermediary; (b) transactions are executed and settled in almost real-time; (c) it maintains a full history of transaction records which are traceable; (d) data contained in the blockchain can hardly be altered or removed once added; and (e) it can be embedded with instructions (such as "if…then…else") to allow transactions or other actions to be carried out only if certain conditions are met.

Applications of the blockchain technology

- According to a survey conducted by an accounting firm in 2016,7Legend symbol denoting See PricewaterhouseCoopers (2016). the greatest level of familiarity with blockchain can be seen among the fund transfer and payments institutions, with 30% of respondents being very familiar with blockchain. Apart from payment transactions, other applications of the blockchain technology include (a) anti-money laundering to better track fund transactions and its destinations;8Legend symbol denoting Banks can use the blockchain technology to track the history of transactions with respect to the origin, ultimate destination and use of funds. This helps improve the ability of banks to identify suspicious customers. See White & Case (2016). and (b) trade invoice financing9Legend symbol denoting Trade invoice financing allows a company to draw money against its sales invoices before the customer has actually paid, thereby improving its cash flow. Companies borrow from banks and financial institutions after furnishing unpaid customer invoices as collateral. to prevent duplicate financing of the same invoice by different banks.10Legend symbol denoting Banks can only detect if the same invoice has been financed by themselves within a prescribed period of time, but they are not able to do so if the same invoice is financed by another bank. By applying the blockchain technology, banks will have the ability to access a single source of information to detect if customers have obtained funding from multiple banks for the same invoices.

- There is also the application of the blockchain technology in securities issuance and trading to ease the settlement process.11Legend symbol denoting For example, the trading order of participant A and participant B is matched on a securities exchange platform. The blockchain-based system is able to verify that participant A owns the stock and participant B owns sufficient cash. The validated transaction is automatically recorded in the asset ledger and cash ledger respectively, eliminating the need for central clearing house. See Oliver Wyman (2016). For instance, NASDAQ in October 2015 launched "Nasdaq Linq" which uses blockchain to facilitate the issuance, cataloging and recording of transfers of shares of privately-held companies on the NASDAQ Private Market.12Legend symbol denoting NASDAQ Private Market enables companies to identify a pool of potential buyers and set parameters on the percentage of holdings that shareholders can sell. Participating shareholders gain liquidity, and the company is able to facilitate the transition of ownership into the hands of long-term institutional holders in advance of a public offering. Other stock exchanges have also shown interest in the blockchain technology. The Australian Securities Exchange is planning to develop blockchain-based solutions to speed up post-trade cash equity clearing and settlement to near real-time. The Japan Exchange Group is examining the potential blockchain application in markets with low transaction volume, whereas the Korea Exchange is reportedly seeking to launch a platform with the blockchain technology for non-listed securities.13Legend symbol denoting See Australian Securities Exchange (2016), Japan Exchange Group (2016), and Korea Times (2016).

- On the global level, financial innovation firm R3 has formed a consortium over 40 financial institutions worldwide to explore the blockchain technology. They collaborate on research, experimentation, design, and engineering to help advance shared ledger solutions to meet banking requirements for security, reliability, scalability, performance and audit.

Challenges of adopting the blockchain technology

- Blockchain technology is gaining much interest in view of its potential to revolutionize financial transactions.14Legend symbol denoting According to an industry report, the amount of investment in the blockchain technology in the capital markets amounted to US$75 million (HK$584 million) in 2015, and is expected to soar to US$400 million (HK$3.11 billion) in 2019. See Aite Group (2015). Yet, there are several challenges blockchain will have to overcome before it becomes mainstream finance in the future. These challenges include:

(a) resources consumption: in a blockchain-based system, each computer connected to the network maintains an identical copy of the ledger which is verified and updated every time a new transaction takes place. Such a decentralized system will likely consume more computing and network resources than a centralized system. As the size of the blockchain continues to grow with more data added, the resources required to operate the system may be more extensive and this draws concern whether the blockchain technology is suitable for large-scale applications; (b) privacy: a blockchain stores a history of transaction records in a network in the form of encryption. While a blockchain application can be operated by institutions in private networks, there are still issues over data privacy. For example, it may be possible to deduce a party's identity inappropriately based on the transactions or through access to a network user that has the permission to decrypt the data. As pointed out by the European Securities and Markets Authority, privacy will be one of the areas that needs to be properly managed;15Legend symbol denoting See European Securities and Markets Authority (2016) and Morrison & Forerster (2016). (c) security: blockchain protocols are often described as secure, but the architecture relies on public-key cryptography. For two decades there has been discussion about whether or not larger quantum computers could break public-key cryptographic systems, if and when they arrive with sufficient "qbits".16Legend symbol denoting See Long Finance (2014).

In addition, there are implications of moving an ever-growing chain of blocks around a distributed set of participants. The International Criminal Police Organization has cautioned that the blockchain technology currently utilized by virtual currencies is vulnerable to the cyber threat that malicious software and other illegal data may be embedded in the transactions and spread across the blockchain;17Legend symbol denoting See International Criminal Police Organization (2015). and(d) regulatory oversight: a legal framework has yet to be developed to protect the rights of the blockchain technology users or govern the organizations utilizing the technology in the financial industry.18Legend symbol denoting Nevertheless, there are still regulations governing the use/trading of virtual currencies in a few places such as Brazil and the New York State of the United States. See BBVA (2016), CFA Institute (2016), and Commodity Futures Trading Commission (2016). As pinpointed by the Financial Conduct Authority of the United Kingdom, innovation can be an iterative process and in order to give innovators "space" to develop their solutions, the Authority will not take a stance until the blockchain application is clearer. It nevertheless recognizes that there are a lot of regulatory and consumer issues that will need to be addressed as the blockchain technology evolves.19Legend symbol denoting According to Financial Conduct Authority (2016), these issues include how individuals gain access to a distributed network, who have the right to control the process, and what data security exists for users. Indeed, successful application of the blockchain technology requires an effective regulatory regime to ensure that the technology is resilient to shocks or criminal activities.20Legend symbol denoting See UK Government Office for Science (2016).

Concluding remarks

- Blockchain has gained considerable attention and interest in recent years. It is seen as an innovative approach to the conventional way of record keeping and clearing financial transactions. In particular, it removes the need for reconciliations between participants through a third party, speeds up the settlement of transactions or completely revamps the existing processes. Many financial institutions and service providers around the world have already started to invest in the blockchain technology and explore its potential applications. That said, although the technology shows a lot of promise, challenges to adoption remain.

- According to the Steering Group on Financial Technologies, Hong Kong has the potential to become a key blockchain hub through leveraging its high concentration of industry domain experts and institutions in finance, logistics and other professional services. Yet other Asian economies have also jumped on the blockchain bandwagon to explore the potential applications of the technology. In particular, the Singapore government's technology arm, Infocomm Development Authority of Singapore, in collaboration with two commercial banks, has recently completed an experimental demonstration delivering the first application of the blockchain technology to ensure the security of trade finance invoicing.21Legend symbol denoting See Infocomm Development Authority of Singapore (2015) and the website of Coindesk.

Prepared by Tiffany NG

Research Office

Information Services Division

Legislative Council Secretariat

20 April 2016

Endnotes:

References:

| 1. | Aite Group. (2015) Demystifying Blockchain in Capital Markets: Innovation or Disruption?

|

| 2. | Australian Securities Exchange. (2016) Media Release: ASX Selects Digital Asset To Develop Distributed Ledger Technology For The Australian Equity Market.

|

| 3. | Bank of England. (2014) Innovations in payment technologies and the emergence of digital currencies.

|

| 4. | BBVA. (2016) Bitcoin and blockchain: threats and opportunities for the financial industry.

|

| 5. | CFA Institute. (2016) Are Bitcoin and Blockchain Technology the Future?

|

| 6. | CoinDesk. (2016) Official website.

|

| 7. | Deloitte. (2016) Blockchain - Enigma. Paradox. Opportunity.

|

| 8. | DTCC. (2016) Embracing Disruption - Tapping The Potential Of Distributed Ledgers To Improve The Post-Trade Landscape.

|

| 9. | Evry. (2015) White Paper - Blockchain: Powering the Internet of Value.

|

| 10. | European Securities and Markets Authority. (2016) Financial Innovation: towards a balanced regulatory response. Speech by Verena Ross, Executive Director. 7 March.

|

| 11. | Financial Conduct Authority. (2016) UK FinTech: Regulating for innovation. Speech by Christopher Woolard, FCA Director of Strategy and Competition, delivered at the FCA's event on UK FinTech: Regulating for innovation. 22 February.

|

| 12. | IBM. (2016) On the Blockchain nobody knows that you're a fridge?

|

| 13. | Infocomm Development Authority of Singapore. (2015) Media Releases: Singapore demonstrates World's First Application of distributed ledger technology in Trade Finance.

|

| 14. | International Criminal Police Organization. (2015) INTERPOL cyber research identifies malware threat to virtual currencies.

|

| 15. | Japan Exchange Group. (2016) News Release: Commencement of Proof of Concept Testing for Blockchain Technology.

|

| 16. | Long Finance. (2014) Chain Of A Lifetime: How Blockchain Technology Might Transform Personal Insurance.

|

| 17. | Morrison & Foerster LLP. (2016) Demystifying Blockchain and Distributed Ledger Technology - Hype or Hero? 5 April.

|

| 18. | NASDAQ. (2015) Press Releases: Nasdaq Linq Enables First-Ever Private Securities Issuance Documented With Blockchain Technology.

|

| 19. | Oliver Wyman. (2015) The Fintech 2.0 Paper: Rebooting Financial Services.

|

| 20. | Oliver Wyman. (2016) Blockchain in Capital Markets.

|

| 21. | PricewaterhouseCoopers. (2016) Blurred lines: how FinTech is shaping Financial Services.

|

| 22. | Sutardja Centre for Entrepreneurship & Technology of the University of California Berkeley. (2015) Blockchain technology beyond Bitcoin.

|

| 23. | The Financial Times (2015) Technology: Banks seek the key to blockchain. 2 November.

|

| 24. | The Korea Times. (2016) KRX seeks share trading through blockchain. 29 February.

|

| 25. | UK Government Office for Science. (2016) Distributed Ledger Technology: beyond block chain.

|

| 26. | U.S. Commodity Futures Trading Commission. (2016) First, Do No Harm. Special Address of CFTC Commissioner J. Christopher Giancarlo Before the Depository Trust & Clearing Corporation 2016 Blockchain Symposium: Regulators and the Blockchain. 29 March.

|

| 27. | White & Case. (2016) Beyond Bitcoin: The blockchain revolution in financial services. |