ISE13/15-16

| Subject: | information technology and broadcasting, commerce and industry, CEPA, creative industries, film industry |

- After a prolonged downturn for almost two decades since the early 1990s, the local film industry has stabilized in recent years, buoyed in part by the preferential access to the huge film market in the Mainland under the Closer Economic Partnership Arrangements ("CEPA").1Legend symbol denoting Under CEPA, filmmakers in Hong Kong are granted preferential access to the Mainland market which is not available to other foreign companies. The key provisions include (a) Chinese language films produced by Hong Kong companies and approved by Mainland authorities are not subject to the import quota set for foreign films, currently stands at 34 a year under the revenue sharing model; (b) films co-produced by Hong Kong and the Mainland are treated as Mainland productions, provided that one-third of the major cast are Mainlanders; (c) Hong Kong companies are allowed to set up wholly-owned units in constructing or renovating cinemas for film-screening business; and (d) Hong Kong films in Cantonese can be distributed in Guangdong via designated channels, with improved profit sharing arrangement. Under CEPA, while local movies entirely produced by Hong Kong companies can be exempt from the import quota set for foreign movies in the Mainland, Hong Kong-Mainland co-production can also be distributed as domestic movies in the Mainland. In view of the robust trend growth of around 40% in the film market in the Mainland over the past decade, Hong Kong-Mainland co-production now takes up more than half of the movies produced by Hong Kong film makers.

- Film industry is one of the six creative industries in Hong Kong and the Government has since 1999 established the Film Development Fund ("FDF")2Legend symbol denoting FDF was launched in 1999 to finance projects conducive to the long-term development of the film industry, but its scope was expanded in 2007 to provide financial support for production of small-to-medium budget films. The ceiling of production budget of these films under support was raised from HK$5 million to HK$25 million in 2015. As at March 2015, FDF provided a total of some HK$83 million for partial financial support to production of 30 films, assisting 29 local talents in taking up the position of directors and producers for the first time in commercial film production. to foster its development. In the 2016 Policy Address, the Chief Executive declares "encouraging more local film production, nurturing new talent, building up audiences and promoting the Hong Kong film brand" as his policy targets. The 2016-2017 Budget includes two funding measures for the film industry, namely injecting additional HK$200 million to FDF and providing a publicity subsidy of HK$20 million to assist Hong Kong-produced Cantonese films to enter the Guangdong market.

- However, there are concerns that these measures are too modest for a strong recovery in the local film industry, as discussed in the earlier meetings of the Panel on Information Technology and Broadcasting. Members are concerned about a lack of long-term policy on local film development and insufficient provision of local cinemas.3Legend symbol denoting The subject of film development was discussed at the Panel meeting held on 9 March 2015. This issue of Essentials reviews the development of the local film industry in recent decades, followed by a brief discussion on its challenges in the short to medium term.

Recent developments of the film industry in Hong Kong

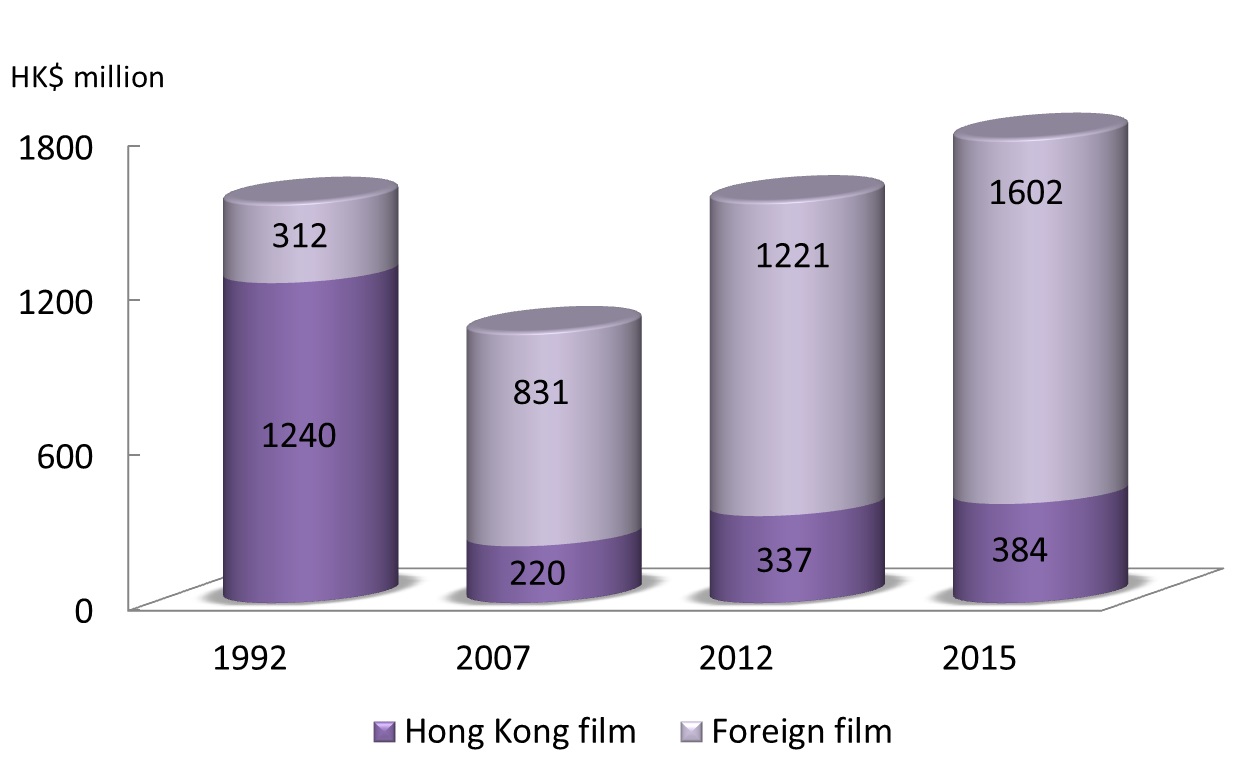

- The box office of overall Hong Kong movies (including both local production and co-production with Mainland partners) reached a record high of HK$1,240 million in 1992, but it then plummeted by a cumulative of around 80% in the next 15 years to a low of only HK$220 million in 2007. In spite of a noticeable rebound to HK$384 million in 2015, the box office of overall Hong Kong movies at present is just about three-tenths of the peak seen in 1992 (Figure 1).4Legend symbol denoting In 2015, there were altogether 332 movies screened in cinemas in Hong Kong, 59 or 18% of which were Hong Kong movies (including co-production with Mainland partners), while 273 or 82% were foreign movies.

Figure 1 - Box office in Hong Kong by film category

Data sources: Census and Statistics Department and Commerce and Economic Development Bureau. - To a certain extent, the protracted downturn in the local film industry since the early 1990s could be attributable in part to the cyclical weakness in the Hong Kong economy. Yet more importantly, this setback was also precipitated by the following structural developments in the film entertainment market:

(a) Shrinking number of cinema seats: Spurred by the buoyant property market and facing increasing competition from home video entertainment such as VCDs and DVDs, many big local cinemas have been demolished for development into more lucrative residential and commercial buildings. In 2015, there were only 47 cinemas left with 37 800 available seats, down by 60% and 70% compared with 119 cinemas and 122 000 seats in 1993. This inevitably has a strong adverse impact on the overall box office in Hong Kong. (b) Crowded out by foreign movies: Local audiences have been increasingly attracted to imported movies especially the big-budget Hollywood movies, in line with the viewing preference of audiences elsewhere. As a result, the box office of foreign movies in Hong Kong increased four-folds over the past two decades to HK$1,602 million in 2015, quadrupling their share in the overall box office of Hong Kong from around 20% in 1992 to about 80% in 2015. By contrast, the share of Hong Kong movies plunged from around 80% to around 20% over the same period (Figure 1 above). (c) Weakening overseas appetite for Hong Kong movies: Overseas box office used to be an important revenue source of Hong Kong movies in the 1980s and 1990s, especially from Taiwan, South Korea and Southeast Asia. Yet overseas appetite for Hong Kong movies likewise waned since the early 1990s, as overseas audiences were drawn to Hollywood movies as well. It is estimated that the overseas box office for Hong Kong movies (excluding the Mainland market) plunged by more than 80% from a peak of HK$1,860 million in 1992 to just around HK$300 million in 2014.5Legend symbol denoting See鍾寶賢:《香港影視業百年》and Hong Kong Film Development Council (2015). (d) Rampant film piracy activity: Worse still, pirated VCDs and DVDs had severely undermined the business receipts of local film makers in the 1990s. According to an estimate made by the trade in 1998, piracy had resulted in a 30% drop in box offices, causing a loss of some HK$300 million to the local film industry. This loss would widen to HK$1 billion if overseas distribution was also included.6Legend symbol denoting See GovHK (1998). In the more recent years, although film piracy through VCDs and DVDs seems to have subsided, there are concerns over infringement of film copyright on the Internet such as through illegal streaming platforms.

Rising importance of co-production after CEPA implementation

- The local film industry began to bottom out after the implementation of CEPA, supported by the booming box office in the Mainland which witnessed a 20-fold surge within a decade to RMB$44 billion (HK$54.2 billion) in 2015. As this market is about 27 times that of Hong Kong, it has widened considerably the market horizon of local film makers. In addition, Hong Kong-Mainland co-production can also widen the sources of investment funds of local film makers on the one hand, and create more job opportunities for local talents on the other. The contribution of co-produced movies to the film business in Hong Kong can be manifested in the following indicators:

(a) Co-production accounting for half of Hong Kong movies: The annual number of co-production with Mainland partners has gone up sharply, from about 10 before 2004 to about 25-30 during the period 2010-2014. Compared with the annual production of 43-56 Hong Kong movies produced, co-production persistently accounts for a share of more than 50% in recent years.7Legend symbol denoting See Commerce and Economic Development Bureau (2015). (b) Co-production commanding better box office in Hong Kong: Co-produced movies are generally better received in local box office, due in part to bigger production budget and more attractive cast. In 2014, there were 27 co-produced movies screened in Hong Kong, commanding a combined box office of HK$234 million, twice the respective sum of HK$115 million for those 23 local movies produced by Hong Kong companies.8Legend symbol denoting See香港影業協會(2014). (c) Co-production taking up one-seventh of the box office in the Mainland: Co-produced movies are likewise well-received across the boundary, as the movie stars and filming techniques of Hong Kong are still highly valued by Chinese audiences. In 2014, co-produced movies had a combined box office of RMB$4.1 billion (HK$5.1 billion) in 2014, accounting for 14% of the overall box office in the Mainland. - In line with this stabilization, the business performance9Legend symbol denoting In the compilation of business performance statistics, film industry covers motion picture, video and television programme production, sound recording and music publishing activities. See Census and Statistics Department (2015a). of the local film industry improved over the past decade. First, the number of business establishments of the local film and related industries expanded by a cumulative 33% during 2005-2014, while business receipts also went up by 25%. Secondly, the number of persons working in these industries rose by a total of 38% to almost 9 000 persons in 2014. Thirdly, the value-added contribution of these industries surged by 75% to HK$2.5 billion in 2014. By and large, they account for 0.1% of overall GDP and 0.2% of total employment in Hong Kong.

Challenges of the local film industry in the short to medium term

- Looking ahead, it is expected that the colossal film market in the Mainland will continue to be the key focus of the local film industry, but it is not without challenges. First, film makers in the Mainland are more sophisticated and self-sufficient in film making and this may reduce the opportunities for co-production with Hong Kong film makers over time. In fact, Mainland filmmakers can shoot big budget and quality movies themselves now. For instance, the number of Hong Kong-Mainland co-production in the top 10 domestic movies in the Mainland in terms of box office has dwindled progressively in recent years, from seven in 2012 to only two in 2014.10Legend symbol denoting See Commerce and Economic Development Bureau (2015b). This gives rise to the concerns whether overall Hong Kong movies and its filming crew can sustain its competitiveness across the boundary in the medium term.

- Secondly, Hong Kong movies need to face intensifying competition from foreign movies especially from Hollywood. By virtue of its attractive cast and big production budget, foreign movies are under strong demand in the Mainland. While imported movies accounted for only 16% of the films commercially released for screening in the Mainland in 2015, they took up almost 40% of the overall box office.11Legend symbol denoting See the reports on box office released by the State Administration of Press, Radio, Film and Television in the Mainland in various years. Reportedly, import quota for foreign movies under the revenue sharing model is likely to be relaxed further in the next review scheduled for 2017, after a lift from 20 to 34 in 201212Legend symbol denoting To the most extent, foreign movies are imported to the Mainland through the revenue sharing model, with a quota initially fixed at 10 in the 1990s and subsequently increased to 34 in 2012. Foreign producers including Hollywood filmmakers can claim up to 25% of the box office under this model. This apart, the Mainland also imports around 30 foreign movies each year through buying the distribution rights at a flat rate. Hong Kong movies may need to improve the quality in order to maintain competitiveness against foreign movies. Moreover, in view of the decreasing trend of cinema seats available in Hong Kong, local movies face an uphill battle to compete with popular Hollywood movies for screening in local cinemas.

Prepared by CHEUNG Chi-fai

Research Office

Information Services Division

Legislative Council Secretariat

23 March 2016

Endnotes:

References:

| 1. | Census and Statistics Department. (2015a) Key Statistics on Business Performance and Operating Characteristics of the Information and Communications, Financing and Insurance, Professional and Business Services Sectors.

|

| 2. | Census and Statistics Department. (2015b) Statistical Digest of the Service Sector.

|

| 3. | Commerce and Economic Development Bureau. (2015a) Funding Support for the Film Development Fund. LC Paper No. CB(4) 590/14-15(03).

|

| 4. | Commerce and Economic Development Bureau. (2015b) Power-point presentation materials in Chinese, Funding Support for the Film Development Fund. LC Paper No. CB(4)595/14-15(01).

|

| 5. | Commerce and Economic Development Bureau. (2015c) Reply to Question raised by the Hon Tang Ka-piu on development of cinemas in Hong Kong, 29 April 2015.

|

| 6. | GovHK. (1998). 'Letter from HK' by Secretary for Trade and Industry, 30 May 1998.

|

| 7. | GovHK. (2016) The 2016 Policy Address.

|

| 8. | GovHK. (2016) The 2016-2017 Budget.

|

| 9. | Industry, Commerce and Technology Bureau. (2004) Measures to facilitate the development of the local film industry. LC Paper No. CB(1)1326/03-04(02).

|

| 10. | US-China Economic and Security Review Commission. (2015) Directed by Hollywood, Edited by China: How China's Censorship and Influence Affects Films Worldwide.

|

| 11. | 史文鴻:《世紀交接下的香港電影的危機與轉機》,載於李少南編:《香港傳媒新世紀》,香港,香港中文大學出版社2003年版。

|

| 12. | 香港票房有限公司:《2015年香港電影市道整體情況》,2016年1月4日。

|

| 13. | 香港影業協會:《香港電影資料彙編》,2012-2014年度。

|

| 14. | 黃愛玲:《回歸十五年:香港電影專輯》,《今天》,2012年冬季號,總99期。

|

| 15. | 鍾寶賢:《香港影視業百年》,三聯書店(香港)有限公司2011年版。 |