ISE02/20-21

| Subject: | economic development, fuels, consumer protection, competition, transparency |

- In Hong Kong, the tax-adjusted pump price of gasoline has gone up by 21% to HK$11.24/litre over the past decade, making it the most expensive in the world.1Legend symbol denoting According to International Energy Agency, Hong Kong topped the highest pump price in the world in 2019, more than doubled the world average. More recently in mid-October 2020, it was amongst the top based on another ranking source. See International Energy Agency (2020) and GlobalPetrolPrices.com (2020). This contrasts against a concurrent 39% plunge in its import cost to only HK$2.73/litre, giving rise to allegations that local oil companies are engaging in various anti-competitive practices for earning "unreasonably high profit".2Legend symbol denoting Legislative Council Secretariat (2019). Such alleged malpractices include "price-fixing" amongst oil companies, and rapid upward price adjustment but slow in downward adjustment.3Legend symbol denoting Also named as "rocket and feather pricing", it means a quicker and larger upward adjustment in pump prices in the up-cycle but slower and smaller downward price adjustment in down-cycle of international oil price. As such, oil companies are alleged to pocket the price differences. As auto-fuel is a necessity affecting millions of drivers and vehicle commuters, price transparency of auto-fuel has been discussed time and again at the Legislative Council ("LegCo") on at least 10 occasions over the past five years.4Legend symbol denoting Over the past five years, seven Council Questions on auto-fuel prices were raised at the Council meetings of 27 January 2016, 4 May 2016, 22 February 2017, 24 May 2017, 15 January 2020, 29 April 2020 and 20 May 2020 respectively, while Members discussed competition of local auto-fuel market in three meetings of the Panel of Economic Development on 22 May 2017, 17 July 2018 and 29 April 2019 respectively, with two motions passed for "further promoting market competition", "lowering product prices" and "commence a formal investigation". See GovHK (2016a, 2016b, 2017a, 2017b, 2020a, 2020b and 2020c) and Legislative Council Secretariat (2017, 2018 and 2019).

- To address these allegations, both the Consumer Council and Competition Commission ("CC") have repeatedly studied the local market of auto-fuel. Their findings pinpointed a few unique local factors (e.g. high excise duty and land cost) which might have contributed to ultra-high fuel price.5Legend symbol denoting Consumer Council (1999, 2015, 2016 and 2020) and Competition Commission (2017). Yet these two public bodies did not find "hard evidence of anti-competitive conduct", partly because they were unable to access necessary data (such as cost and profit) from the oil companies for in-depth analysis. In view of this data limitation and in its report published in May 2017, CC suggested a need to be vested with compulsory information gathering ("CIG") power in future market studies to address lingering public concerns.6Legend symbol denoting Competition Commission (2017).

- Globally, competition authorities in some 58 places are authorized by law to gather necessary data from stakeholders in market studies, including the auto-fuel market.7Legend symbol denoting Organisation for Economic Co-operation and Development (2016). Amongst them, Australia is globally acclaimed to have struck a proper balance between granting CIG power to the regulatory authority in market studies and protection of business interests and data confidentiality of stakeholders.8Legend symbol denoting Organisation for Economic Co-operation and Development (2013). This issue of Essentials discusses the CIG power for market studies in Australia, after a brief summary of recent trend in gasoline pricing in Hong Kong.

Recent developments of auto-fuel pricing in Hong Kong

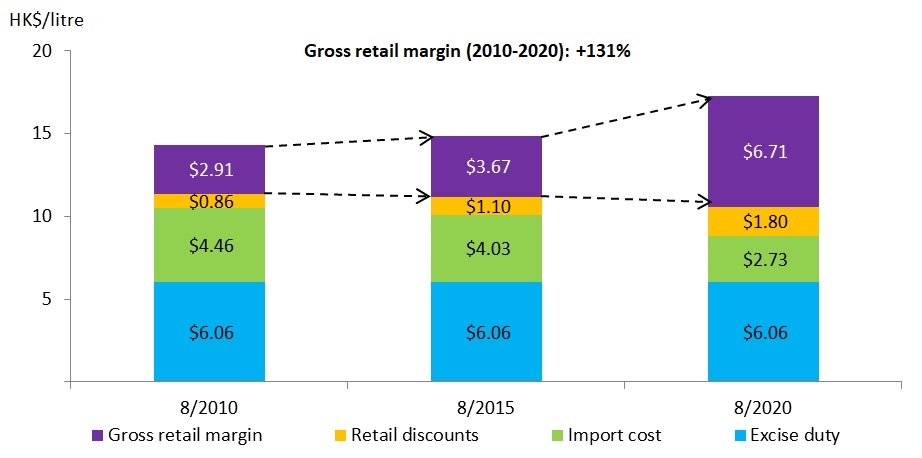

- Local gasoline pricing: In August 2020, the retail price of unleaded gasoline averaged at HK$17.3/litre (Figure 1). Netting out the excise duty of HK$6.06/litre, the adjusted pump price was HK$11.24/litre, four times the average import cost of HK$2.73/litre and five times the global oil price (Brent) of HK$2.2/litre. Gross retail margin (i.e. the spread between the tax-adjusted retail price and import cost as well as retail discounts) stood at HK$6.71/litre in August 2020, more than doubling that in August 2010 and precipitating suspicions that local oil companies did not pass the full benefits of falling oil prices to consumers. Little variations in pump prices amongst five retailers also give rise to suspicion of the anti-competitive practice of "price-fixing".9Legend symbol denoting Legislative Council Secretariat (2019) and Consumer Council (2020).

Figure 1 - Gross retail margin of unleaded gasoline in Hong Kong

Sources: Census and Statistics Department and Legislative Council Secretariat.

- Recent study findings on the auto-fuel market: In view of these public concerns, the Consumer Council and CC have conducted several studies on the auto-fuel market over the past decade. In a recent report published in May 2017, CC points out that the local gasoline market is characterized by (a) ubiquitous retail discounts given to drivers with an effect of reducing ex-duty unleaded pump price by an average of some $0.8-$1.5/litre during 2011-2016; (b) higher land cost and construction cost for all of 181 petrol filling stations in the territory; and (c) higher operating cost. As such, CC "could not rule out the possibility" that these factors have "largely or wholly" contributed to the aforementioned widening in gross retail margins. Moreover, the two features of "high and consistent" gasoline prices across oil companies on their own "cannot be taken as hard evidence of anti-competitive conduct", as these could be an outcome of market forces and similar cost structure faced by five major oil companies.

- Data limitation of existing market studies: However, the above studies do little help to attenuate public scepticism because they were based largely on publicly available materials and information voluntarily provided by the oil companies. The two public bodies cannot have access to vital data (e.g. cost, profits and net margin) of stakeholders, dampening public creditability of such market studies. As a matter of fact, CC remarks that "we did not always receive the data we requested from parties, and the resulting 'gaps' have prevented us from undertaking some analyses with the degree of rigour required to draw robust inferences". In face of this caveat, CC asked for CIG power in future market studies in its 2017 report, but this recommendation was not accepted by the Government.10Legend symbol denoting The Government took a reserved stance on such recommendation as the existing power of CC was drawn up after "having balanced different considerations" and thorough discussions in LegCo before 2015. Also, CC has operated for just a few years requiring more time to consider a review. See GovHK (2017b).

- CIG power in market studies not the same as formal investigation power in enforcement: On 29 April 2019, the Panel on Economic Development passed a motion urging CC to invoke the "formal investigation power" (e.g. use of search warrants and CIG power) under the Competition Ordinance (Cap. 619) to look into the suspected anti-competitive conduct in the auto-fuel market.11Legend symbol denoting CC replied that the motion could not compel a launch of an investigation. See Legislative Council Secretariat (2019). Yet CC responded that it would be invoked only when "there was a reasonable cause to suspect a contravention of a competition rule".12Legend symbol denoting Commerce and Economic Development Bureau (2019).

- Key issues of concerns: CIG power in market studies can lead to several beneficial effects in society, such as enhancing pricing transparency and competition, providing more evidence-based analysis on business practice, and rectifying public misconception of key market players. On the other hand, there are business concerns that CIG power in market studies may interfere with business operations in a free market economy. As cost and profit data are privileged information of any enterprise, public bodies should not ask for them unless they have strong social grounds. Also, there are concerns over confidentiality of business data.13Legend symbol denoting Organisation for Economic Co-operation and Development (2016), Legislative Council Secretariat (2004) and GovHK (2016b).

Compulsory information gathering power in the Australian auto-fuel market

- Australia has become more reliant on overseas oil supply since the 2000s, upon closure of major local refineries due to their waning competitiveness against regional suppliers. The share of imports in the overall supply of auto-fuel in Australia thus surged from 5% in 1999 to 35% in 2019. By mid-October 2020, the Australian pump price of unleaded gasoline was A$1.19 (HK$6.67)/litre, just about one-third of that in Hong Kong and amongst the lowest in advanced economies. While this is attributable in part to lower excise duty in Australia at only A$0.423 (HK$2.37), a more diversified mix of retailers (e.g. supermarkets, oil companies and independent retailers) also help boost competition.

- Market-based regulatory framework and informal price monitoring after 1998: The auto-fuel market in Australia used to be subject to rigid price regulation for five decades till 1998 for consumer protection, but this excessively interventionist approach was deemed to have "adverse effect on the retail petrol market".14Legend symbol denoting ACCC ceased to exercise CIG power to compel oil companies to provide detailed data of prices, costs and profits for auto-fuel price control until mid-1998, as price control aggravated the disparity of auto-fuel prices between capital cities and country areas. See Australian Competition and Consumer Commission (2008). This led to a gradual change towards a more relaxed and market-based regulatory regime centralised by the Australian Competition and Consumer Commission ("ACCC") established since 1995.

In 1998, the petrol price in Australia was de-regulated and left to market forces. While ACCC still monitored the petrol price, its role was minimized with the use of publicly available data and information voluntarily disclosed by stakeholders only. This was called "informal" price monitoring, contrasted against "formal" price monitoring with the use of confidential company information before 1998. - Reinstatement of CIG power for price monitoring in 2007: Yet the Australian community felt that such informal price monitoring by ACCC was inadequate to safeguard motorists' benefits, as manifested in widening gap between local pump price and global oil price in the mid-2000s.15Legend symbol denoting Parliament of Australia (2006) and Australian Competition and Consumer Commission (2007). Retail margin per litre widened sharply by 64% from A$0.033 (HK$0.19) in the first half of 2005 to A$0.054 (HK$0.3) in the second half of 2006. In the two inquiries conducted by the Australian Parliament and ACCC during 2006-2007, they concluded that competition was "not fully effective" in certain segments of the auto-fuel market. In response to strong public demand, ACCC has enhanced its price monitoring role since December 2007, reinstating its CIG power mandatorily requiring oil companies to provide confidential data for formal monitoring.16Legend symbol denoting Australian Competition and Consumer Commission (2007).

- Key features of CIG power in the auto-fuel market: So far, ACCC has executed CIG power to conduct market studies in four sectors, namely auto-fuel, airports and aviation, electricity and container stevedoring. CIG power in Australia is vested in the Competition and Consumer Act 2010 ("CCA"), with the following salient features in its application to the auto-fuel market :

(a) Requiring ministerial approval beforehand: Usually, ACCC asks the oil companies to voluntarily provide the necessary data first, but it would invoke the CIG power if they do not do so. Under CCA, such CIG power of ACCC must obtain the approval of the Treasurer beforehand. The Ministerial direction (covering the objectives, scope and information required for monitoring) thus issued is usually valid for one to three years only;17Legend symbol denoting Ministerial direction is a sort of check and balance for formal price monitoring, due in part to the criticism of its excessive use before 1998. The Australian government has renewed the direction six times in a row since late-2007 to extend the formal auto-fuel price monitoring until December 2022. See Productivity Commission (2001). (b) Protection of data confidentiality: CCA has the following safeguard measures to protect "commercial confidentiality" of data providers. First, ACCC can only have access to those specific confidential data stipulated by the Ministerial direction. Secondly, findings of the market studies must be presented at an aggregate level in a way that nobody can derive company-specific data. Thirdly, members of ACCC illegally disclosing protected data are subject to imprisonment of two years, unless such disclosure is necessary in the public interest; (c) Data coverage for necessary analysis: With CIG power, ACCC can have access to confidential datasets from each major market participant in all business segments (i.e. retail, refinery and wholesale), covering sales volume, prices, costs and profits for in-depth analysis. ACCC will assess the profitability of the market and decide whether (i) pump price is economically efficient; (ii) cost base is efficient; and (iii) rate of return on capital of oil companies is reasonable;18Legend symbol denoting The key quantitative indicators utilized for measuring the profitability of the industry include: (a) gross profit; (b) gross margin; (c) net profit; (d) return on sales; (e) return on assets; and (f) return on capital employed. ACCC will then use financial models with these indicators to analyse the financial performance of the industry. See Australian Competition and Consumer Commission (2017). and (d) Comment from oil companies in data coverage: Before requesting information, ACCC would consult industry participants on specified data templates. In view of their comments and concerns, ACCC might refine data requirements and data templates. If the stakeholders feel that the mandatory data request or penalty imposed is unacceptable, they may appeal to the court.19Legend symbol denoting Parties failing to comply with information requests made under CIG power or providing false or misleading information to ACCC will be fined A$4,440 (HK$24,908) per offence. - Increased pricing transparency in the auto-fuel market with the use of CIG Power in Australia: With the mandatory CIG power, ACCC published price monitoring report in the auto-fuel market annually before 2013, and quarterly since end-2014. Amongst its main findings, ACCC notes that while the gross retail margin of auto-fuel in Australia increased by a total of 63% to A$0.104 (HK$0.58)/litre during 2010-2018, the confidential company data reveals that it was primarily because of surging operating costs. Factoring out additional cost, net profit actually held stable at 13%-14% of gross retail margin over the same period.20Legend symbol denoting Australian Competition and Consumer Commission (2020).

- Favourable response to such market studies: The market studies based on confidential data "contributed to a more informed public debate and reduced community concerns about some aspects of fuel markets". Even the oil companies appreciate the crucial role played by ACCC in clarifying public misperceptions about the auto-fuel market. Actually, the number of complaints lodged to ACCC on auto-fuel has plummeted by 76% to 880 cases during 2008-2019.21Legend symbol denoting Australian Competition and Consumer Commission (2007 and 2019). Globally, Australian market studies were well recognized because they can distinguish "price movements that reflected healthy competition and those representing anomalies", enhancing market transparency.22Legend symbol denoting Organisation for Economic Co-operation and Development (2013).

Prepared by LEUNG Chi-kit

Research Office

Information Services Division

Legislative Council Secretariat

21 October 2020

Endnotes:

| Hong Kong

| |

| 1. | Census and Statistics Department. (2020) Table 130: Unit Values of Imports of Selected Oil Products.

|

| 2. | Commerce and Economic Development Bureau. (2019) Government's response on Motion Passed under Agenda Item III on "Report on the work of the Competition Commission" at Meeting on 29 April 2019. LC Paper No. CB(4)966/18-19(01).

|

| 3. | Competition Commission. (2017) Report on Study into Hong Kong's Auto-fuel Market.

|

| 4. | Consumer Council. (1999) Energizing the Energy Market: A Study of Motor Gasoline, Diesel and LPG Markets in Hong Kong.

|

| 5. | Consumer Council. (2015) Auto-fuel Price Monitoring Analysis.

|

| 6. | Consumer Council. (2016) Report on Auto-Fuel Price Monitoring 2016.

|

| 7. | Consumer Council. (2020) Auto-fuel Price Monitoring Analysis 2020.

|

| 8. | GovHK. (2016a) LCQ18: Prices of auto-fuels and domestic liquefied petroleum gas.

|

| 9. | GovHK. (2016b) LCQ8: Fuel prices.

|

| 10. | GovHK. (2017a) LCQ22: Competition conditions of auto-fuels market in Hong Kong.

|

| 11. | GovHK. (2017b) LCQ1: Competition Commission's report on Hong Kong's auto-fuel market.

|

| 12. | GovHK. (2020a) LCQ6: Retail prices of auto-fuels.

|

| 13. | GovHK. (2020b) LCQ13: Fuel prices.

|

| 14. | GovHK. (2020c) LCQ8: Promoting competition in fuel market.

|

| 15. | Legislative Council Secretariat. (2004) Retail prices of oil products. Background brief submitted to the Panel on Economic Services of the Legislative Council. LC Paper No. CB(1)487/04-05.

|

| 16. | Minutes of meeting on Economic Development of the Legislative Council. (2017) 22 May. LC Paper No. CB(4)1479/16-17.

|

| 17. | Minutes of meeting on Economic Development of the Legislative Council. (2018) 17 July. LC Paper No. CB(4)1560/17-18.

|

| 18. | Minutes of meeting on Economic Development of the Legislative Council. (2019) 29 April. LC Paper No. CB(4)1221/18-19.

|

| 19. | Legislative Council Secretariat. (2020) Tables and graphs showing the import and retail prices of major oil products from September 2018 to August 2020 furnished by the Census and Statistics Department. LC Paper No. CB(4)908/19-20(01).

|

| Australia

| |

| 20. | Australian Competition and Consumer Commission. (2007) Petrol prices and Australian consumers: Report of the ACCC inquiry into the price of unleaded petrol.

|

| 21. | Australian Competition and Consumer Commission. (2008) Monitoring of the Australian petroleum industry: Report of the ACCC into the prices, costs and profits of unleaded petrol in Australia.

|

| 22. | Australian Competition and Consumer Commission. (2017) Statement of regulatory approach to assessing price notifications under Part VIIA of the Competition and Consumer Act 2010.

|

| 23. | Australian Competition and Consumer Commission. (2019) Report on the Australian petroleum market: June quarter 2019.

|

| 24. | Australian Competition and Consumer Commission. (2020) Financial performance of the Australian downstream petroleum industry 2002 to 2018.

|

| 25. | Australian Competition and Consumer Commission. (various years) ACCC & AER annual report.

|

| 26. | Department of the Environment and Energy. (2019) Australian Energy Update 2019.

|

| 27. | Parliament of Australia. (2006) Inquiry into the Price of Petrol in Australia.

|

| 28. | Productivity Commission. (2001) Review of the Price Surveillance Act 1983 Inquiry Report. Report No. 14.

|

| Others

| |

| 29. | GlobalPetrolPrices.com. (2020) Most expensive gasoline in the world.

|

| 30. | International Energy Agency. (2020) Energy Prices 2020.

|

| 31. | Organisation for Economic Co-operation and Development. (2013) Competition in Road Fuel.

|

| 32. | Organisation for Economic Co-operation and Development. (2016) The Role of Market Studies as a Tool to Promote Competition.

|

Essentials are compiled for Members and Committees of the Legislative Council. They are not legal or other professional advice and shall not be relied on as such. Essentials are subject to copyright owned by The Legislative Council Commission (The Commission). The Commission permits accurate reproduction of Essentials for non-commercial use in a manner not adversely affecting the Legislative Council. Please refer to the Disclaimer and Copyright Notice on the Legislative Council website at www.legco.gov.hk for details. The paper number of this issue of Essentials is ISE02/20-21.