ISE06/20-21

| Subject: | home affairs, welfare services, charities |

- Hong Kong is a highly philanthropic society, as manifested in a three-fold upsurge in tax-exempt charitable donations in 18 years to a record high of HK$12.7 billion in 2019. However, the stock of some 9 200 charitable organizations ("charities") is currently subject to weak oversight, as regulatory responsibilities are dispersed among 18 bureaux and departments.1Legend symbol denoting 香港政府一站通(2017年)。 Due to regulatory gaps with lack of coordination, reports concerning mismanagement and malpractice of charities occur from time to time, including improper usage of public donations and operation of profit-making hotels on land granted by the Government at nil or concessionary premium.2Legend symbol denoting During 2013-2015, media reported that 14 sites granted to charities were used to run hotels. As three of the sites were granted on unrestricted leases, the Audit Commission only reviewed the other 11 cases and found indications of commercial operation. See Audit Commission (2017). Not only have these scandals undermined public trust in the charity sector, they also have led to widespread concerns that the existing regulatory regime is "fragmented and ineffective".3Legend symbol denoting Office of The Ombudsman (2003).

- During 2003-2019, five public bodies reviewed the regulatory regime of charities, including Office of the Ombudsman, Independent Commission Against Corruption, Law Reform Commission ("LRC"), Audit Commission and Public Account Committee. Most of them recommended a more comprehensive regulatory framework to (a) maintain a register of charities meeting a statutory definition; (b) regulate fund-raising activities; and (c) safeguard proper usage of public donations. While LRC suggested that these could be done through setting up a single regulator, the Government expressed strong reservation in 2017 because of "no consensus in the community", with some charities expressing concerns about the power of such an authority.4Legend symbol denoting HKSARG (2017). For this reason, the Government has instead introduced some administrative measures to improve transparency of fundraising activities.

- Many advanced places (e.g. Australia, Singapore and the United Kingdom) have also put forward regulatory reforms to improve accountability and transparency of charities. More specifically, Australia changed its regulatory approach from a decentralized model to a more centralized one in 2012, and this approach is considered to have more policy implications for Hong Kong. This issue of Essentials discusses the regulatory reform of charities in Australia, after a brief review of the local regulatory regime.

Regulatory regime for charities in Hong Kong

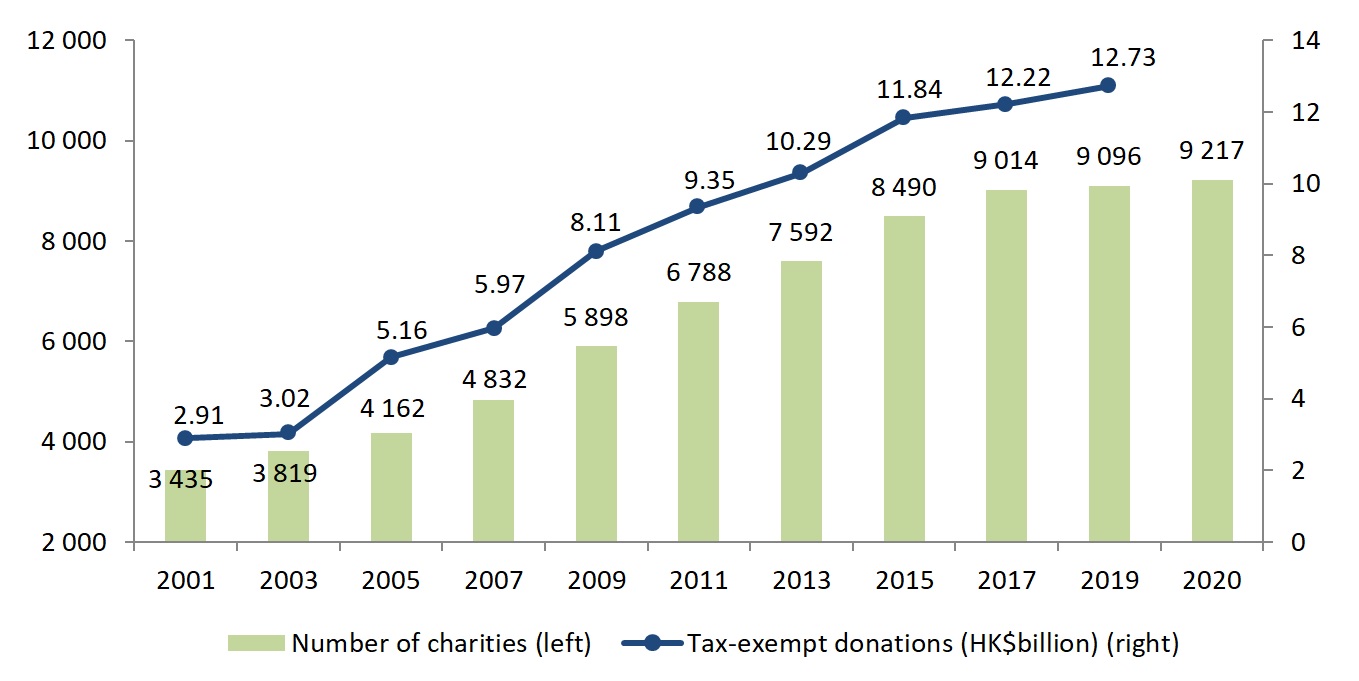

- Surging charities and sizable public donations: Since 2001, the number of charities registered with the Inland Revenue Department ("IRD") for tax exemption has increased by 168% to some 9 200 in 2020 (Figure 1). Public donations increased even more, by 337% to HK$12.7 billion in 2019, representing 0.4% of GDP.5Legend symbol denoting This excluded other forms of donation, such as proceeds raised through flag days and other fundraising activities permitted by Social Welfare Department averaging some HK$0.2 billion each year for the past decade. See Audit Commission (2017). According to a global ranking of propensity to donate in 146 places around the world, Hong Kong took a high position of 18th in 2018.6Legend symbol denoting Charities Aid Foundation (2018).

Figure 1 - Charities and tax-exempt donations in Hong Kong (1), (2)

| Notes: (1) | Including donations exempted from salary tax, profits tax and personal assessment since 2003. For 2001, the figure only includes exemptions from the first two types of tax. |

| (2) | As at 31 March each year. |

| Source: Inland Revenue Department. | |

- Fragmented regulatory regime: At present, there is no statutory definition of "charities" in Hong Kong, let alone a dedicated charity law or a single regulatory authority. Major statutory provisions concerning charitable status are on tax exemptions for organizations with "charitable purposes" and charitable donations upon amendments to the Inland Revenue Ordinance ("IRO")(Cap. 112) in 1949 and 1970.7Legend symbol denoting Public Accounts Committee (2018) and Inland Revenue Department (2020a and 2020b).

That said, nine bureaux and nine departments are directly or indirectly involved in the oversight of charities, depending on the nature and activities of the charities. For instance, on the legal form of a charity, it is overseen by the Companies Registry if it is registered as a company, but by the Police Force if registered as a society. On fund-raising activities, flag selling is regulated by the Social Welfare Department ("SWD") and lotteries by the Home Affairs Department ("HAD"). If charities ask for government support, IRD is responsible for tax concessions, Lands Department for land grants, and other authorities for pertinent subventions (e.g. Education Bureau for subventions to education charities). - Key issues arising from regulatory gaps: The absence of a single consolidated authority for overall governance could give rise to regulatory gaps and leave room for malpractice of charities. First, while charities need to submit annual reports and financial accounts to IRD for maintaining their tax-exemption status, IRD has no power to withdraw their charity status or to demand corrective measures for misuse of funds.8Legend symbol denoting Inland Revenue Department ("IRD") can only revoke the tax-exemption status of a charity in situations such as cessation of operation, non-response to its enquiries and failure to maintain charitable nature. See Audit Commission (2017). Secondly, as the Government has no regulatory power over some emerging fundraising forms (e.g. online and direct debit donations), charities need not disclose the use of their proceeds collected from such means to the public. Thirdly, while statutory charities with subventions are usually subject to more stringent oversight, those do not receive government subsidies and operate in the form of society or trust are subject to minimal scrutiny.9Legend symbol denoting IRD only requires charities to submit annual reports and accounts from time to time, usually once every three years. See Inland Revenue Department (2020b). Fourthly, it is not easy for the public and donors to monitor the governance and financial situation of over 9 200 charities, in the absence of a one-stop information portal. Fifthly, "charitable purposes" in IRO are based on English case law back in 1891, covering mainly poverty relief, education and religion purposes.10Legend symbol denoting While organizations with other purposes beneficial to the community may also apply for charity status, they only accounted for 15% of all registered charities during the year of assessment 2019-2020, according to figures provided by IRD. They are not aligned with charitable purposes in contemporary society (e.g. protection of animal welfare and promotion of human rights), causing hurdles to operation of some charities.

- Malpractice incidents of charities: In the report published by the Audit Commission in 2017, at least six charities were noted to have used their funds improperly, with one charity even paying remunerations as much as HK$13 million to its directors in three years. Moreover, at least 11 land sites granted to charities were used for running profit-making hotel services. While one charity made a total profit of HK$70 million in three years, some did not reveal their profitability or submit financial reports to pertinent authorities. As regards 1 430 on-street fund-raising activities during 2012-2016, one-third recorded very high administration costs, accounting for over 20% of proceeds.11Legend symbol denoting Audit Commission (2017). On top of them, there are press reports on mismanagement of charities from time to time.

- Recent developments: In 2013, LRC put forward 18 recommendations to address the aforementioned regulatory gaps, including (a) introducing a statutory definition of charitable purposes with updated categories; (b) keeping a centralized register of charities; (c) enhancing information transparency of charities; and (d) setting up a charity commission in the long run.12Legend symbol denoting Law Reform Commission (2013). These recommendations were echoed by the Audit Commission in 2017.13Legend symbol denoting Audit Commission (2017).

However, the Government did not pursue most of these recommendations on the grounds of "no consensus in the community". Instead, IRD tightened its oversight of financial reporting of charities, revoking the charity status of 370 organizations in 2017-2018. Also, some administrative measures were introduced to enhance transparency in fundraising activities in August 2018 and April 2019, such as (a) uploading audited accounts of fundraising activities under the purview of SWD and HAD to a public page; (b) setting up a hotline for public enquiries; and (c) introducing a logo for the public to identify fundraising activities with permits.14Legend symbol denoting GovHK (2018 and 2019). Reportedly, Home Affairs Bureau is still coordinating views from various authorities regarding further reforms on overall regulation of charities.15Legend symbol denoting HKSARG (2019 and 2020).

Recent regulatory reforms for charities in Australia

- Australia has a vibrant charity sector, with altogether 57 900 charities in 2019. Public donations to Australian charities reached A$10.5 billion (HK$61.5 billion) and represented 0.6% of GDP in 2018.16Legend symbol denoting ACNC (2020). According to the aforementioned global survey, public propensity to donate in Australia was ranked the third highest in the world in 2018, just after Myanmar and Indonesia.17Legend symbol denoting Charities Aid Foundation (2018).

- Fragmented regulatory framework before 2012: Similar to Hong Kong, charity regulation in Australia used to be fragmented before 2012, with a wide range of federal and state regulators overseeing various aspects of charities (e.g. tax exemption, legal forms and fundraising activities). For instance, 19 agencies were involved in determining the status of a charity based on 178 pieces of legislation.18Legend symbol denoting The Treasury (2011). Not only did it lead to inconsistent regulatory requirements and inefficient regulation, it also exerted heavy compliance burden on the fast-growing charity sector since the 1980s upon increased government subvention.19Legend symbol denoting Industry Commission (1995) and Murray (2019).

- Regulatory reviews: In response to rising public calls, the Australian government launched seven reviews over the regulatory regime of charities during 1995-2011. While all these reviews recommended setting up a single regulator and harmonizing regulations, implementation was put on hold during 1996-2007 due to the change of government. Not until return of the Australian Labour Party to power in 2007 did the Australian government put the regulatory reform into practice.20Legend symbol denoting During 1996-2007, a series of conservative governments were elected. They opposed creation of a new regulator and preferred a more traditional and narrow definition of charities. See McGregor-Lowndes et al. (2017).

- Key features of a centralized regulatory regime: Two dedicated laws, namely Australian Charities and Not-for-profits Commission ("ACNC") Act and Charity Act were enacted during 2012-2013, resulting in changes in the regulatory framework. Here are the salient features:

(a) Statutory definition of charities: For the first time in the Australian history, the Charity Act provides a statutory definition of charities applicable to all federal legislation. In short, a charity must be (a) not-for-profit; (b) only for charitable purposes; and (c) for public benefit. Moreover, the Charity Act lists out 12 charitable purposes, including those of contemporary society such as animal welfare, environmental protection and promotion of human rights. Politically, charities are not allowed to show support for a specific political party or candidate, but advocacy for changes in law and policy is counted as one of the charitable purposes;21Legend symbol denoting Federal Register of Legislation (2013). (b) Single regulatory authority: In December 2012, ACNC was established to oversee operation of all charities, with around 100 staff exercising its investigative and enforcement power.22Legend symbol denoting Staff of Australian Charities and Not-for-profits Commission ("ACNC") is deployed from the Australian Taxation Office ("ATO"), which had a total staff of some 19 000 in 2019. See Australian National Audit Office (2020). If charities breach the governance standards (e.g. by using money on non-charitable purposes), ACNC can give warnings, remove responsible persons and revoke registration. While other government agencies may still need to monitor charities for matters under their own purviews (e.g. licensing for fundraising activities), ACNC helps through information sharing and coordination of enforcement action;23Legend symbol denoting Murray (2019). (c) Central register of charities for public scrutiny: ACNC keeps a register of charities, regardless their legal forms. Charities must register in order to receive government benefits (e.g. tax concessions) and are required to submit governance and financial information annually in a standard format.24Legend symbol denoting To avoid excessive burden on small charities, those with annual revenue less than A$250,000 (HK$1.4 million) only need to fill in a standard form while those with over A$1 million (HK$5.4 million) must submit an audited financial report as well. See The Treasury (2018). Such information, along with history of non-compliance, is made publicly available on a "one-stop-shop" web portal; (d) Harmonization of regulatory requirements: To reduce compliance burdens on charities, ACNC works with other government agencies to weed out inconsistencies in regulatory requirements. In addition, a file-sharing service called "Charity Passport" was launched in 2014, letting other regulatory agencies access information submitted by charities and hence reducing the need for duplicated reporting; and (e) Accreditation scheme as additional information for donors: In 2016, ACNC launched an accreditation scheme named as "Registered Charity Tick", assisting the public in identifying well-managed charities meeting standards on transparency and accountability. Only qualified charities can display the logo during fundraising. - Policy effectiveness: The regulatory reforms seem to have borne fruit after eight years of operation in Australia. First, ACNC has improved overall regulatory efficiency, with 21 government agencies sharing charity data through "Charity Passport" in June 2019. The regulatory savings to charities were significant, estimated at A$18.6 million (HK$101.2 million) in 2019.25Legend symbol denoting A consultancy study in 2014 also confirmed that ACNC paperwork only amounted to 0.1% of compliance burden on charities. See Ernst & Young (2014) and Australian National Audit Office (2020). Secondly, according to a survey in 2015, the majority (88%) of charities supported ACNC in recognition of its role in red tape reduction and advocacy for the sector.26Legend symbol denoting Among the 1 100 charity executives surveyed, 58% preferred regulation by ACNC, followed by co-regulation (30%). There was little support for self-regulation (7%) and regulation by ATO. See Probono Australia (2015a). Even though the Liberal-National Coalition intended to undo the reforms after winning the election in 2013, the plan was shelved due to objection from the charity sector.27Legend symbol denoting Probono Australia (2015b). Thirdly, ACNC appears to be able to maintain diversity of the charity sector in Australia, without complaints over unreasonable targeting on political grounds.28Legend symbol denoting Murray (2019). While 19 000 charities were removed from the central register (i.e. one-third of the stock of charities in 2019) during 2013-2019, it was mostly due to closure of the charities and their failure to comply with reporting requirements, not vetting of their activities.29Legend symbol denoting ACNC (2019). Fourthly, the Australian National Audit Office concluded in its audit report published just in 2020 that ACNC was "largely effective" in regulation of charities. Fifthly, the level of public trust in charities hovered at a high level of 86%-90% in Australia during 2013-2017.30Legend symbol denoting The figures refer to the percentage of respondents reporting moderate and high trust in charities. See Kantar Public (2017).

- That said, there have been continued concerns over some problematic fundraising tactics (e.g. aggressive street fundraising causing public nuisances), precipitating suggestions for extending the nationwide regulatory oversight to fundraising activities in the country.31Legend symbol denoting The Treasury (2018).

Prepared by Germaine LAU

Research Office

Information Services Division

Legislative Council Secretariat

10 November 2020

Endnotes:

References:

| Hong Kong

| |

| 1. | Audit Commission. (2017) Report No. 68 of the Director of Audit.

|

| 2. | Financial Services and the Treasury. (2017) Letter to Public Accounts Committee on Government's support and monitoring of charity. 16 May.

|

| 3. | GovHK. (2018) Government announces administrative measures to enhance transparency of charitable fund-raising activities and safeguard donors' interests. 1 August.

|

| 4. | GovHK. (2019) Government introduces logo for charitable fund-raising activities for easy identification. 1 April.

|

| 5. | HKSARG. (2017) The Government Minute in Response to the Report of the Public Accounts Committee No. 68 of July 2017. 18 October.

|

| 6. | HKSARG. (2019) The Government Minute in Response to the Report of the Public Accounts Committee No. 71 of February 2019. 15 May.

|

| 7. | HKSARG. (2020) The Government Minute in Response to the Report of the Public Accounts Committee No. 73 of February 2020. 27 May.

|

| 8. | Inland Revenue Department. (2020a) Departmental Interpretation And Practice Notes No. 37 (Revised): Concessionary Deductions: Section 26c Approved Charitable Donations.

|

| 9. | Inland Revenue Department. (2020b) Tax Guide for Charitable Institutions and Trusts of a Public Character.

|

| 10. | Law Reform Commission. (2013) Charities.

|

| 11. | news.gov.hk. (2009) ICAC issues fund-raising guidelines. 6 October.

|

| 12. | Office of The Ombudsman. (2003) The Investigation Report on the Monitoring of Charitable Fund-Raising Activities.

|

| 13. | Official Records of Proceedings of the Legislative Council. (2018) 17 January.

|

| 14. | Public Accounts Committee. (2018) P.A.C. Report No. 68A.

|

| 15. | 香港政府一站通:《民政事務局局長談政府對慈善機構的監管》,2017年7月12日。

|

| Australia

| |

| 16. | ACNC. (2019) ACNC Annual Report 2018-19.

|

| 17. | ACNC. (2020) Australian Charities Report 2018.

|

| 18. | Australian National Audit Office. (2020) Regulation of Charities by the Australian Charities and Not-for-profits Commission.

|

| 19. | Ernst & Young. (2014) Research into Commonwealth Regulatory and Reporting Burdens on the Charity Sector.

|

| 20. | Federal Register of Legislation. (2013) The Charity Act 2013.

|

| 22. | Industry Commission. (1995) Charitable Organisations in Australia.

|

| 22. | Kantar Public. (2017) ACNC Public Trust and Confidence in Australian Charities.

|

| 23. | McGregor-Lowndes, M. (2017) Australia: Co-Production, Self-Regulation and Co-Regulation. Breen, O. B. et al. (ed.). Regulatory Waves: Comparative Perspectives on State Regulation and Self-regulation Policies in the Nonprofit Sector. Cambridge: Cambridge University Press.

|

| 24. | McGregor-Lowndes, M. et al. (ed.). (2017) Regulating Charities: The Inside Story. New York: Routledge.

|

| 25. | Murray, I. (2019) Regulating Charity in a Federated State: The Australian Perspective. Nonprofit Policy Forum. 22 January.

|

| 26. | Probono Australia. (2015a) 2015 Sector Survey.

|

| 27. | Probono Australia. (2015b) Government Not Abolishing ACNC.

|

| 28. | The Treasury. (2011) Consultation Paper - Scoping study for a national not-for-profit regulator.

|

| 29. | The Treasury. (2018) Strengthening For Purpose: Australian Charities And Not For Profits Commission.

|

| Others

| |

| 30. | Charities Aid Foundation. (2018) CAF World Giving Index 2018.

|

| 31. | Chevalier-Watts, J. (2018) Charity Law: International Perspectives. New York: Routledge.

|

Essentials are compiled for Members and Committees of the Legislative Council. They are not legal or other professional advice and shall not be relied on as such. Essentials are subject to copyright owned by The Legislative Council Commission (The Commission). The Commission permits accurate reproduction of Essentials for non-commercial use in a manner not adversely affecting the Legislative Council. Please refer to the Disclaimer and Copyright Notice on the Legislative Council website at www.legco.gov.hk for details. The paper number of this issue of Essentials is ISE06/20-21.