Promotion of private funding for sports development in Japan

ISE02/2022

Subject: home affairs, sports development

- In Hong Kong, after the historic winning of six medals (one gold, two silvers and three bronzes) at the Tokyo Olympic Games in August 2021, there are strong and renewed calls in the community to provide more support to 1 300 elite athletes under intensive training at Hong Kong Sports Institute ("HKSI") and over 60 subvented sports associations ("SAs") under the Sports Subvention Scheme ("SSS") administrated by the Leisure and Cultural Services Department. At present, these bodies are heavily reliant on recurrent funding from the Government, amounting to HK$1.2 billion in 2020 and taking up almost nine-tenths of their annual budgets.1The figures refer to the sum of SSS, Arts and Sport Development Fund and Elite Athletes Development Fund received by 60 subvented SAs and HKSI as in March 2020. See Legislative Council (2017b) and 明報(2021). There are thus policy suggestions to encourage more donations and sponsorships from the private sector to better support sports development locally. Over the past five years, the subject of financial support to local sports and elite athletes has been discussed in the Legislative Council ("LegCo") on at least 10 occasions.2GovHK (2021a, 2021b, 2021c, 2021d), Legislative Council (2017a, 2017b, 2021) and Legislative Council Secretariat (2019).

- Local private funding on sports development is confined to three major areas, namely (a) sponsoring 12-15 mega-sports events like marathon, golf and rugby annually; (b) sponsoring a few subvented SAs in popular sports such as football; and (c) offering financial awards to athletes with exceptional achievement. Yet this sort of private funding is sporadic, transitory and limited, especially so for "minority sports" (i.e. lesser-known sports with smaller audience and media coverage). Most recently in the 2021 Policy Address, the Chief Executive proposed to study the idea of "professionalisation of sports and development of sports industry". A Working Group chaired by the Secretary for Home Affairs ("SHA") will discuss the proposal with local "business and sports sectors" in due course.3Policy Address (2021).

- Globally, public funding on elite and popular sports is almost a universal practice, but a few of affluent places (e.g. Australia, Japan and South Korea) are making discernible progress in diversifying their sports funding, such as securing funding from the business sector. As increased private sector funding in Japan is hailed as one of the key factors for its continued sporting achievement, this issue of Essentials looks into its policy experience, after a quick review of sports funding in Hong Kong.4De Bosscher et al. (2015) and Leisure and Cultural Services Department (2020).

Recent developments on sports funding in Hong Kong

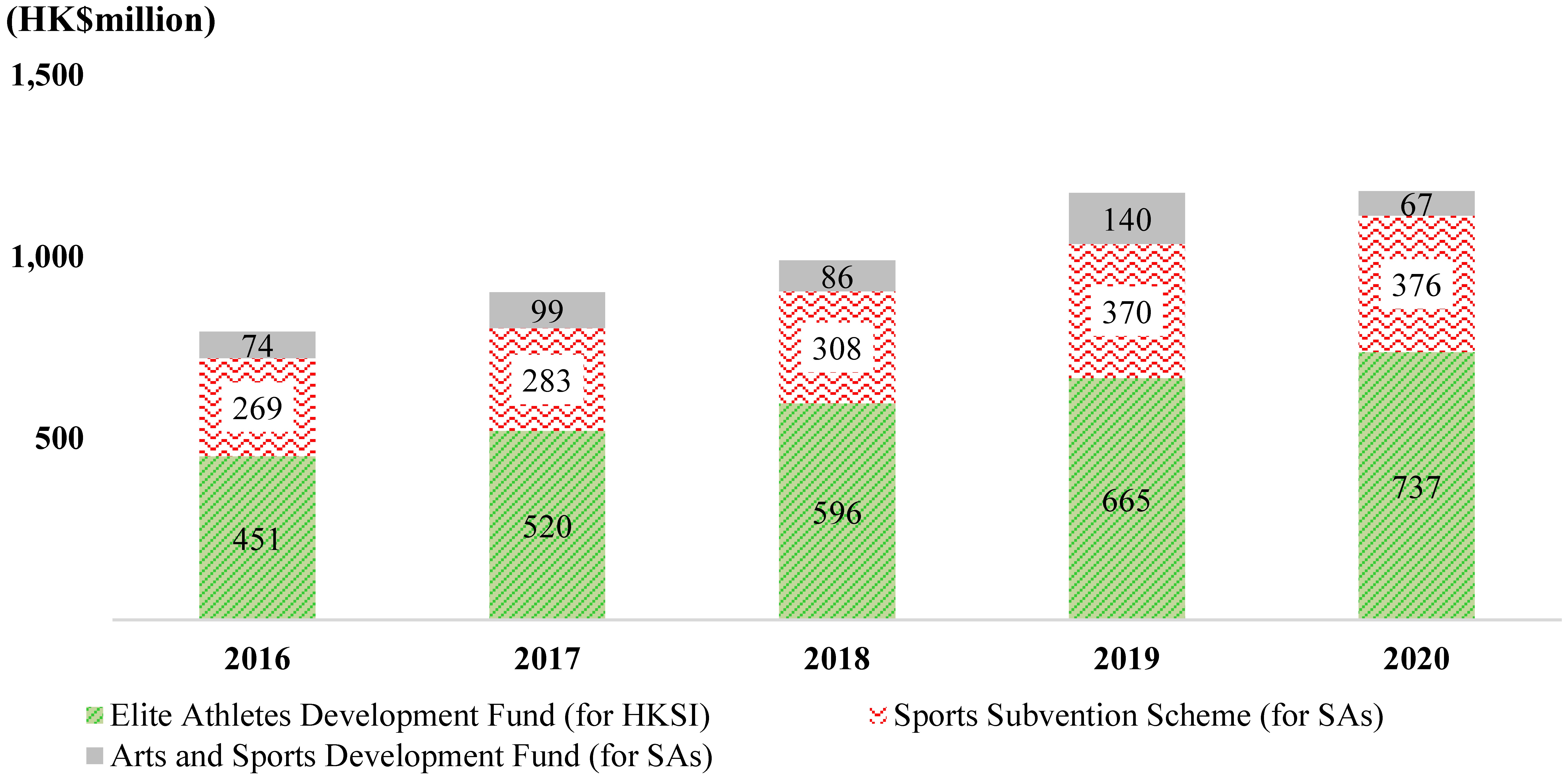

- Public funding as the lifeblood of local elite and popular sports: In 2020, there were about 1 300 elite athletes receiving intensive training at HKSI (525 of whom were full-time athletes receiving a monthly allowance in the region of HK$7,130-HK$48,240), while 60-plus subvented SAs also play a key role in promoting elite and popular sports. Government funding by far is the lifeblood of these sports, with HKSI receiving an annual income of HK$737 million allocated from the Elite Athletes Development Fund in 2020-2021, and all subvented SAs obtaining subventions of HK$443 million under both SSS and the Arts and Sport Development Fund (Figure 1). On average, public funding as a whole accounts for about 87% of the recurrent income of these bodies.5Data were retrieved from annual reports or financial statements under SSS (if the former is unavailable) of HKSI and NSAs. See Hong Kong Sports Institute (2020), GovHK (2021b, 2021c) and Home Affairs Bureau (2021).

Figure 1 – Major public subventions on elite and popular sports Sources: Home Affairs Bureau and Hong Kong Sports Institute.

Sources: Home Affairs Bureau and Hong Kong Sports Institute.

- Tight fiscal balance restraining pace of expansion: When community sports programmes are included, recurrent public spending on sports increased by 29% in four years to hit HK$6 billion in 2020-2021, representing 0.2% of Gross Domestic Product ("GDP"). As this ratio is already higher than Singapore and South Korea (0.1%), and considering that the Government is facing fiscal deficits for two consecutive years, the prospect of further substantial allocation of resources to sports development from the public coffers looks rather remote in the medium term.6International Monetary Fund (2021) and Home Affairs Bureau (2021).

- Non-existence of a self-financing sports industry: Turning to the private sector, local sports market is apparently too small to support the athletic careers. Football (one of the most popular sports locally) is a vivid example. After more than 40 years of professionalization, self-generated income (e.g. gate receipts) and sponsorships took up only 15% of the annual income (HK$20 million) of the Hong Kong Football Association in 2019-2020, far less than the combined share of funding (71%) from the Government and Hong Kong Jockey Club.7Hong Kong Football Association (2020), 明報(2019) and 香港01 (2021). For subvented SAs of minority sports (e.g. sailing and softball), the situation could be even more lopsided.As such, creating an environment for the sports industry to strive for self-financing and self-sustaining is not without challenges. It is expected that the Working Group to be chaired by SHA will take a wider perspective to look into commercial feasibility of the proposed sports industry, as well as necessary facilitative measures. This piece will attempt to focus on a narrower area on sports sponsorship and donation from the private sector.8Policy Address (2021).

- Existing private funding on local sports: At present, sports sponsorship in Hong Kong comes mostly from large corporations, partly for marketing and corporate social responsibility. This is usually seen in the forms of (a) hosting signature events such as marathon, rugby and golf; (b) supporting some subvented SAs and sports teams, despite mostly in popular sports like football; (c) supporting elite training of individual athletes; and (d) granting financial awards to outstanding elite athletes (e.g. Olympics medallists). For some exceptionally successful athletes, they may also become branding celebrities of commercial advertisements.9GovHK (2021c) and 陳智思(2021).

- Existing measures on incentivizing sports sponsorship: There are very few incentive measures to encourage sports sponsorships in Hong Kong. The only exception is probably the "M" Mark System launched in 2004, under which the Government offers a dollar-for-dollar matching grant on business sponsorship solicited by subvented SAs in hosting top-level sports events, subject to a maximum of HK$10 million per event. Separately, sports sponsorship is also a sort of marketing expense eligible for tax deduction.10Panel on Home Affairs (2020), Legislative Council (2021) and Legislative Council Secretariat (2019). Yet some stakeholders considered that this is not competitive enough relative to other marketing strategies. As such, the Panel on Home Affairs in LegCo passed a motion in May 2019, asking for extra tax deduction on sports sponsorship.11Panel on Home Affairs (2019).

- Key issues of concerns: Stakeholders generally expressed concerns in three major areas as set out below –

-

(a)Gap in expertise in attracting sponsorship: There are doubts whether the Home Affairs Bureau ("HAB") is equipped with multi-disciplinary expertise to promote sports commercialization, even with the creation of the Commissioner for Sports in January 2016. In response to this concern, the Chief Executive proposed in January 2022 to setup a "Culture, Sports and Tourism Bureau" for better policy coordination in the future.Meanwhile, as the mandates of subvented SAs fall mainly on sports development, many such organizations do not have managerial and marketing expertise to deal with business sector;

-

(b)Lack of tax incentives: There is no visible tax incentive for business donations to subvented SAs, as most of them are not registered as tax-exemptible charities at present. For business sponsorship to subvented SAs, it is likewise subject to tight regulations from HAB.12According to the Inland Revenue Ordinance (Cap. 112) ("IRO"), sports organizations including subvented SAs promoting "a particular sport" is not eligible to register as charities for tax exemption. See Inland Revenue Department (2021).Moreover, subvented SAs receiving commercial sponsorships could be liable to profits tax under the Inland Revenue Ordinance (Cap. 112), except incidence of a tax loss. This requirement thus potentially disincentivizes these bodies to conduct more for-profit activities to cross-subsidize the expenses of other sports development initiatives;13Under section 87 of IRO, the Chief Executive in Council may also grant subvented SAs a special tax exemption on a case-by-case basis. According to scattered information disclosed, such exemption was granted to Hong Kong, China Rowing Association in 2020. and

-

(c)Limited support to elite athletes and teams: The monthly allowance of full-time elite athletes yet to achieve top-level gaming results is as low as HK$7,130, and some of them are reportedly forced to give up sports career for more stable living. Also, corporations also lack "a valid justification" to inject further long-term investments for operating local sports teams like football, without much policy support to partly compensate their continued deficits incurred.14Legislative Council (2021) and South China Morning Post (2021). There is thus an advocacy to broaden the sports funding pool, in particular from the private sector.

-

Recent developments on sports funding in Japan

- Japan is considered a major sports powerhouse worldwide, winning 27 gold medals in the 2020 Tokyo Olympics just behind China and the United States. Its funding system on sports development has been increasingly dual-track since the 2000s, with additional contributions from the private sector. Although overall public sports spending surged by 68% amidst intensive preparation for the Olympic Games to ¥974 billion (HK$67 billion) during 2013-2019, public subventions represented just one-fifth (18%) of total income of 70-plus National Sports Associations ("NSAs") in 2020, with the rest from business income (63%) and self-generated revenue (17%). To a considerable extent, this is in part attributable to a large sports market in Japan (estimated at 1.6% of GDP), while policy incentives to encourage funding support to NSAs from enterprises also play a significant role.15International Monetary Fund (2021), 笹川體育財團(2021) and 日本政策投資銀行(2015, 2021).

- Major national sports plan after the 1990s: After the disappointing performance (a total of 14 medals including just three golds) at the Atlanta Olympics in 1996, allegedly due in part to shrinking public subvention amidst prolonged economic downturn, the Japanese government formulated a 10-year sports development plan in 1999. One of its key objectives was to attract new sports funding from the private sector.

- Major measures to solicit private resources in sports development: The Basic Act on Sport ("the Act") was enacted in 2011, emphasizing the importance of developing a sports industry. The Japanese government then designated sports as one of the three key industries to revitalize its economy in June 2016. It aimed to triple the market size of local sports industry within a decade to ¥15 trillion (HK$1 trillion) by 2025, along with a lift in their ratio to GDP from 1.5% to 2.2%.16Ministry of Education, Culture, Sports, Science and Technology (1999, 2010), 文部科學省(2017) and Japan Sports Agency (2021e). Key measures to promote private funding are summarized below:

-

(a)Creating an independent sports bureau: The Japan Sports Agency ("JSA") was established in October 2015 under the Act. JSA is now a dedicated bureau tasked with promotion of sports policies, capable of mobilizing resources across departments and sectors. While JSA is led by sports professionals, one-fifth of its 121 staff was seconded from other ministries for multi-disciplinary coordination. More specifically on soliciting private funding, there is a special division to work with sports organizations and the private sector;17Sasakawa Sports Foundation (2020).

-

(b)Mandatory formulation of business plan by NSAs: To diversify funding, the Japanese government asked all NSAs in 2011 to formulate medium-term commercialization plans spanning over 5-10 years on a voluntary basis. These plans were then made mandatory in 2017, in anticipation of a drop in their revenues after the Tokyo Olympics. In short, NSAs need to give serious thoughts in their plans on how to: (i) improve marketing and technology; (ii) boost self-generated income and new sponsorships; and (iii) visualize the progress of commercialization. Since 2020, JSA commissioned studies on those NSAs with effective plans (e.g. tennis, hockey and triathlon) for sharing good practices.For instance, the Japan Triathlon Union ("JTU") was amongst the earliest NSAs in 2014 to formulate such commercialization plan, setting out targets, creating online media and conducting big data analysis to attract more participants and to promote private sponsorships. As such, business income of JTU had doubled in just five years to ¥1.7 billion (HK$116 million) in 2019;18Recent strategies of the medium-term plan of JTU include (a) commissioned analyses conducted by a university on the profile and spending of participants for each event; (b) launching a one-stop service e-portal and mobile app for enhanced member loyalty embedded with special offers from sponsors; (c) converting player data on the portal for better tournament planning and promotion of new products; and (d) seeking marketing expertise for more sponsorships. See 文部科學省(2015, 2017) and Japan Sports Agency (2020, 2021a, 2021b, 2021c).

-

(c)Matching business partners to NSAs: Similar to subvented SAs in Hong Kong, almost half of NSAs in Japan indicate that they do not have necessary marketing and business expertise to solicit resources from the private sector. In response, JSA initiated a matching programme for selected NSAs in 2020, trying to partner them with big corporations or business start-ups for networking and marketing. More recently in October 2021, the programme is extended to assist professional sports clubs, along with an allowance of a maximum ¥3 million (HK$205,500) from the government for each project to be completed in February 2022;19Japan Sports Agency (2021a, 2021d) and AUBA (2021).

-

(d)Tax deduction to donors for donations to NSAs: Unlike Hong Kong, both corporate and individual donors in Japan are entitled to tax deduction for donations to NSAs mostly registered as Public Interest Corporations ("PIC");

-

(e)Special tax benefits for donations and commercial income of NSAs: Sports promotion is seen as serving public interest in Japan, and sports-related income of NSAs has thus been entitled to corporate tax exemption since 2008 if registered as PIC. Moreover, commercial income from 34 types of designated profit-based business operated by NSAs could be taken as tax-exemptible donation to finance deficits of non-profit lines of sports activities.20There are 17 requirements for compliance of NSAs with PIC status, such as at least half of total expenditure must be related to sports or other charitable purposes. See 國稅廳(2012).For example, the Japan Gymnastics Association received ¥565 million (HK$39 million) or one-third of total income from for-profit business (e.g. marketing sponsorships, retail and publishing) in 2019-2020. Yet its tax expense was just 17% of the originally computed tax amount due in part to its PIC status;21日本體操協會(2020).

-

(f)Incentive for corporation-owned sports clubs: For the three most popular sport leagues (i.e. baseball, football and basketball) in Japan, many clubs are owned and operated by big corporations. To incentivize these corporations to inject more investments to their own sports clubs, full tax deduction is extended to budgetary deficits of their clubs (on top of the aforementioned advertising expenses);22國稅廳(2020) and Japan Football Lab (2021). and

-

(g)Dedicated lottery funds for local sports: To tap funding from society, a dedicated Sports Promotion Lottery (i.e. toto/BIG) was introduced into Japan in 2001. It began with betting on designated local football matches, and then extended to selected overseas football matches in 2013 and further to local basketball league in 2020. During 2006-2020, lottery sales of toto/BIG had sextupled to ¥102 billion (HK$7 billion). While half of its sales is reserved for prize money, three quarters of the remaining profits (after netting out operational expenses) are exclusively designated for subsidizing all kinds of sports projects.23The rest one-fourth of net profits is distributed back to the national treasury as tax payment. See Sasakawa Sports Foundation (2020), B.League (2021) and Japan Sport Council (2021a, 2021b).In 2019, ¥3.6 billion (HK$247 million) or 14% of total subsidies from the lottery were allocated to elite sports and their related sports organizations. More importantly, about seven-tenths (69%) of the subsidies for NSAs was distributed to minority sports which encounter more difficulties in seeking commercial sponsorship.24Contrary to the profits of toto/BIG exclusively for local sports, there are other public sports gambling (e.g. horse racing and cycling) generating indirect resources as tax payment to the government for redistributing back to various social welfare projects including sports more generally, similar to Hong Kong. See Sasakawa Sports Foundation (2017), 笹川體育財團(2021) and Financial Times (2021).

-

- Policy effectiveness: The aforesaid measures seem to have attracted more sports funding from the business sector in Japan. In 2020, 28% of NSAs had formulated their medium-term business plans, with another 46% scheduled to do so before 2022.25笹川體育財團(2021). For a medium-sized NSA with an annual income in the region of ¥300-600 million (HK$21-41 million), the proportion of business income to total revenue had surged by 16 percentage points to 30% during 2014-2018.26For smaller-sized and micro NSAs with annual income in the range of ¥100-300 million (HK$7-21 million) and below ¥100 million (HK$7 million), the proportions of business revenues to total income both increased by five percentage points to 31% and 21% respectively during 2014-2018. See 笹川體育財團(2015, 2021).

Prepared by LEUNG Chi-kit

Research Office

Information Services Division

Legislative Council Secretariat

21 January 2022

Research Office

Information Services Division

Legislative Council Secretariat

21 January 2022

Endnotes:

- The figures refer to the sum of SSS, Arts and Sport Development Fund and Elite Athletes Development Fund received by 60 subvented SAs and HKSI as in March 2020. See Legislative Council (2017b) and 明報(2021).

- GovHK (2021a, 2021b, 2021c, 2021d), Legislative Council (2017a, 2017b, 2021) and Legislative Council Secretariat (2019).

- Policy Address (2021).

- De Bosscher et al. (2015) and Leisure and Cultural Services Department (2020).

- Data were retrieved from annual reports or financial statements under SSS (if the former is unavailable) of HKSI and NSAs. See Hong Kong Sports Institute (2020), GovHK (2021b, 2021c) and Home Affairs Bureau (2021).

- International Monetary Fund (2021) and Home Affairs Bureau (2021).

- Hong Kong Football Association (2020), 明報(2019) and 香港01 (2021).

- Policy Address (2021).

- GovHK (2021c) and 陳智思(2021).

- Panel on Home Affairs (2020), Legislative Council (2021) and Legislative Council Secretariat (2019).

- Panel on Home Affairs (2019).

- According to the Inland Revenue Ordinance (Cap. 112) ("IRO"), sports organizations including subvented SAs promoting "a particular sport" is not eligible to register as charities for tax exemption. See Inland Revenue Department (2021).

- Under section 87 of IRO, the Chief Executive in Council may also grant subvented SAs a special tax exemption on a case-by-case basis. According to scattered information disclosed, such exemption was granted to Hong Kong, China Rowing Association in 2020.

- Legislative Council (2021) and South China Morning Post (2021).

- International Monetary Fund (2021), 笹川體育財團(2021) and 日本政策投資銀行(2015, 2021).

- Ministry of Education, Culture, Sports, Science and Technology (1999, 2010), 文部科學省(2017) and Japan Sports Agency (2021e).

- Sasakawa Sports Foundation (2020).

- Recent strategies of the medium-term plan of JTU include (a) commissioned analyses conducted by a university on the profile and spending of participants for each event; (b) launching a one-stop service e-portal and mobile app for enhanced member loyalty embedded with special offers from sponsors; (c) converting player data on the portal for better tournament planning and promotion of new products; and (d) seeking marketing expertise for more sponsorships. See 文部科學省(2015, 2017) and Japan Sports Agency (2020, 2021a, 2021b, 2021c).

- Japan Sports Agency (2021a, 2021d) and AUBA (2021).

- There are 17 requirements for compliance of NSAs with PIC status, such as at least half of total expenditure must be related to sports or other charitable purposes. See 國稅廳(2012).

- 日本體操協會(2020).

- 國稅廳(2020) and Japan Football Lab (2021).

- The rest one-fourth of net profits is distributed back to the national treasury as tax payment. See Sasakawa Sports Foundation (2020), B.League (2021) and Japan Sport Council (2021a, 2021b).

- Contrary to the profits of toto/BIG exclusively for local sports, there are other public sports gambling (e.g. horse racing and cycling) generating indirect resources as tax payment to the government for redistributing back to various social welfare projects including sports more generally, similar to Hong Kong. See Sasakawa Sports Foundation (2017), 笹川體育財團(2021) and Financial Times (2021).

- 笹川體育財團(2021).

- For smaller-sized and micro NSAs with annual income in the range of ¥100-300 million (HK$7-21 million) and below ¥100 million (HK$7 million), the proportions of business revenues to total income both increased by five percentage points to 31% and 21% respectively during 2014-2018. See 笹川體育財團(2015, 2021).

Essentials are compiled for Members and Committees of the Legislative Council. They are not legal or other professional advice and shall not be relied on as such. Essentials are subject to copyright owned by The Legislative Council Commission (The Commission). The Commission permits accurate reproduction of Essentials for non-commercial use in a manner not adversely affecting the Legislative Council. Please refer to the Disclaimer and Copyright Notice on the Legislative Council website at www.legco.gov.hk for details. The paper number of this issue of Essentials is ISE02/2022.